OIL PRICE FORECAST:

- Oil Continues to Advance as Market Participants Eye Further Cuts by OPEC+.

- Rumors Suggest That There is Still Disagreements Regarding 2024 Quotas Within OPEC+.

- WTI Faces Technical Hurdles While Retail Traders are Overwhelming long on WTI at Present.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Most Read: What is OPEC and What is Their Role in Global Markets?

Oil prices are enjoying a second successive day of gains, up around 1.5% at the time of writing. A lot of the optimism stems from the idea that OPEC+ will announce additional cut at tomorrow’s virtual meeting despite rumors that an agreement is far from being reached.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

OPEC+ MEETING TO DOMINATE

The OPEC+ meeting, which was delayed to tomorrow, November 30 and will be a virtual meeting continues to be the major talking point in relation to oil prices. There has been a back and forth for the majority of the week as rumors swirl around disagreements between countries regarding the supply and output quotas.

Disagreements between African countries like Angola and Nigeria with OPEC heavyweight Saudi Arabia dominated headlines in the early part of the week but based on the recent two day rally it would appear market participants believe a deal will be reached. According to a note from Barclays they do not believe that new target levels for African producers pose an existential threat to OPEC+.

To give an accurate picture of where things stand, around 3 hours ago sources claimed no agreement reached and a further delay to the virtual meeting remains possible. Two hours after this and the Wall Street Journal published a piece citing sources who claim that OPEC+ considering new oil production cuts of as much as 1 million barrels a day with Saudi Arabia supporting the idea while the UAE are reportedly against it.

As i have mentioned before i find these disagreements rather strange given the Global economic outlook and conflicts in the Middle East and Russia/Ukraine. I am at a loss as to why producers are arguing about cuts when an oversupply will see a decline in Oil prices and thus slash profit margins. Thus, selling and producing more will not necessarily lead to an increase in profit and thus my surprise. Looking at the bigger picture and tomorrow’s meeting (should it go ahead) could be a massive one for Oil prices and producers as 2024 draws closer.

Another concern which has helped market participants worried about supply disruptions from Kazakhstan following a major storm in the Black Sea area. The concern is that exports may be disrupted from both Russia and Kazakhstan which could affect upto 2 million barrels per day.

Recommended by Zain Vawda

How to Trade Oil

LOOKING AHEAD

Most of the attention will be fixed on developments at the OPEC+ meeting but we do also have the US Federal Reserves preferred inflation gauge to come this week. We also have a host of Federal Reserve speakers who could add an extra layer of volatility to the US Dollar

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

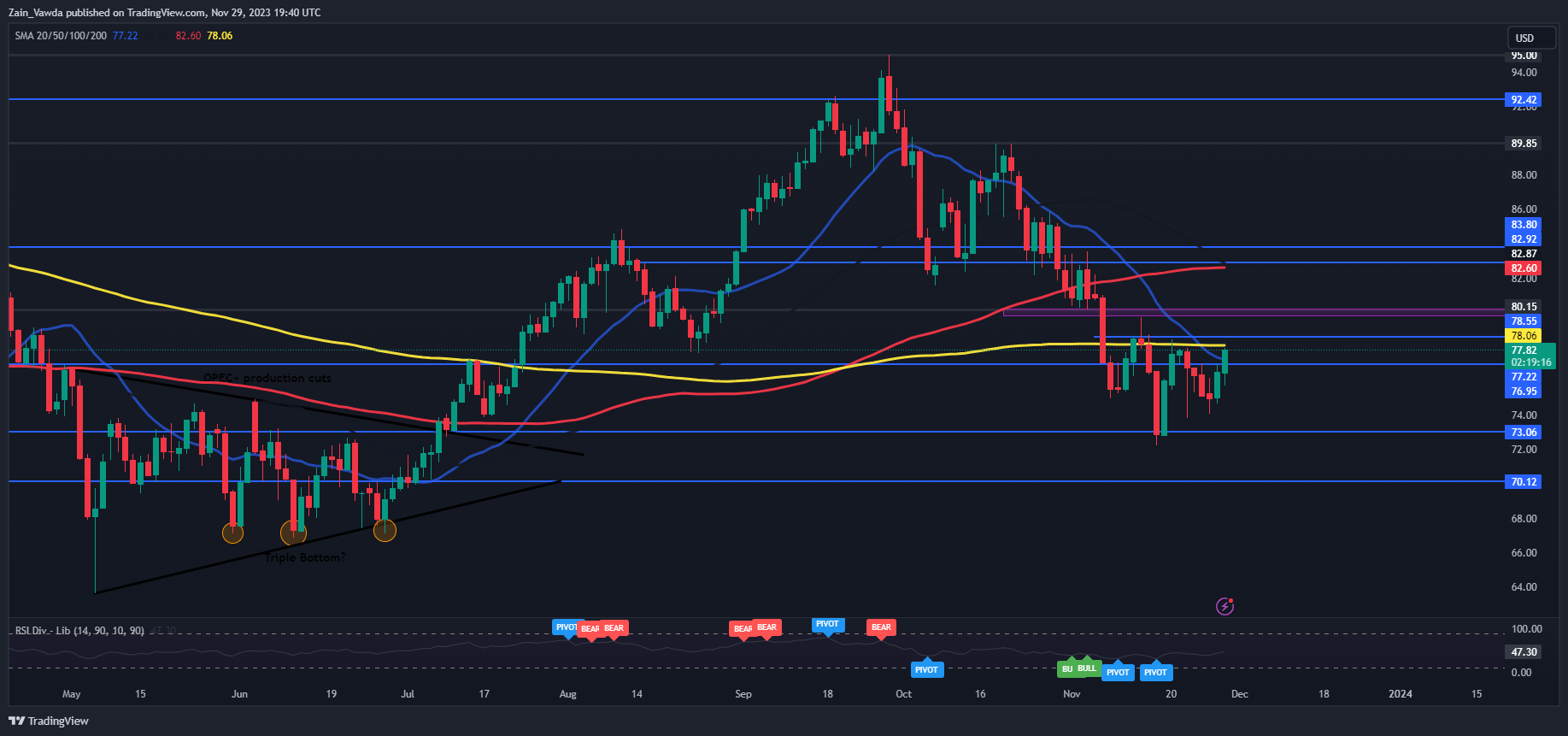

From a technical perspective WTI does appear to have bottomed out having just printed a new higher low as it looks for a change in structure. WTI remains bearish for now with a daily candle close above the $78.55 mark needed for a change in structure and bulls to assume control.

Having already failed once before WTI has to contend with the 200-day MA which rests at the $78.06 mark first if we are to see a change in structure and potentially a retest of the key psychological $80 a barrel mark.

WTI Crude Oil Daily Chart – November 29, 2023

Source: TradingView

Key Levels to Keep an Eye On:

Support levels:

Resistance levels:

IG CLIENT SENTIMENT

IG Client Sentiment data tells us that 82% of Traders are currently holding LONG positions. Given the contrarian view to client sentiment adopted here at DailyFX, does this mean we are destined to revisit recent lows?

For a more in-depth look at WTI/Oil Price sentiment and how to use it, download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | 0% | -12% | -3% |

| Weekly | -5% | 13% | -3% |

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Read the full article here