Crypto exchange Coinbase (COIN) shares have hit an 18-month high after rival exchange Binance and its former CEO Changpeng Zhao pleaded guilty to money laundering and sanctions violations in the United States.

On Nov. 27, Coinbase closed at $119.77, its highest since May 5, 2022, when it closed at $114.25, according to TradingView data. It has seen little movement in after-hours trading.

The number puts Coinbase shares up around 256.5% year-to-date, although is still down 65% from its Nov. 12, 2021, all-time high of nearly $343.

Coinbase’s share surge comes just shy of a week since Binance and founder Changpeng “CZ” Zhao pleaded guilty to money laundering, violating U.S. sanctions and running an unlicensed money-transmitting business.

Zhao and Binance settled with the U.S. for $4.3 billion, which included Zhao stepping down as CEO and Binance agreeing to DOJ and Treasury compliance monitors for up to five years.

Related: Binance charges prove ‘following the rules’ was the right decision — Coinbase CEO

Over the past year Coinbase has also secured a significant windfall with to-be-approved U.S. spot Bitcoin (BTC) and Ether (ETH) exchange-traded funds (ETFs).

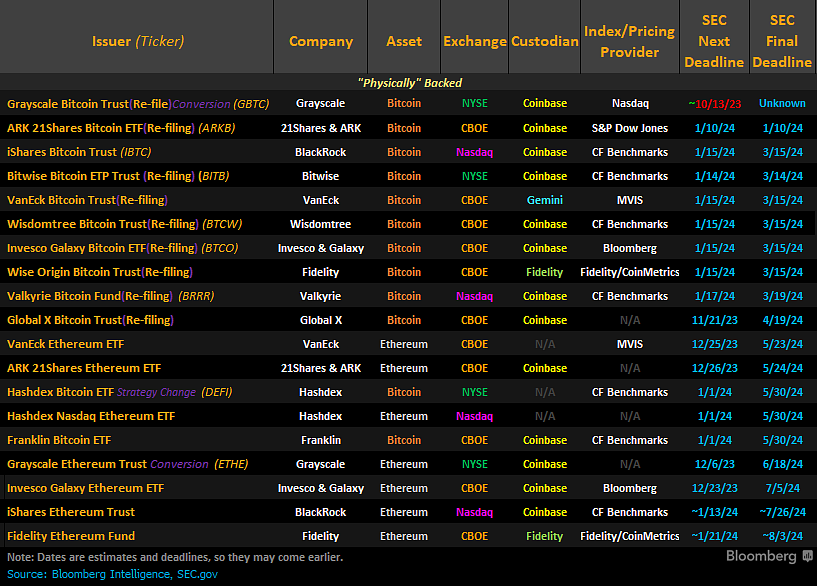

Analysis from Bloomberg ETF analyst James Seyffart shows Coinbase is custodian to 13 of the 19 spot crypto ETFs currently pending with the Securities and Exchange Commission.

Coinbase, however, faces a lawsuit from the SEC which claims the exchange didn’t register with the regulator and listed several tokens that violated U.S. securities laws.

Coinbase had attempted to dismiss the suit and called into question the SEC’s authority to police crypto.

Magazine: Web3 Gamer: 65% plunge in Web3 Games in ’23 but ‘real hits’ coming, $26M NFL Rivals NFT|

Read the full article here