The stablecoin market has seen major shifts in March, with Ethena’s USDtb breaking into the top 10 stablecoins by market cap, Tether losing 61% of market dominance, and EURC’s market cap reaching a new all-time high.

According to CoinDesk’s Stablecoins & CBDCs Report as of March 26, the market capitalization of USDtb, a synthetic stablecoin backed by BUIDL, surged 1,219% in March to $1.18 billion, making it the 8th largest stablecoin by market cap.

This rapid rise coincided with Ethena Labs’ launch of Converge EVM-compatible blockchain in partnership with Securitize, where USDtb stablecoin will serve as the primary currency for transaction fees.

The report also highlighted several other noteworthy trends in the stablecoin sector. Tether (USDT) market dominance fell to 62.1%, the lowest since March 2023, as multiple exchanges delisted the stablecoin due to non-compliance with MiCA regulations.

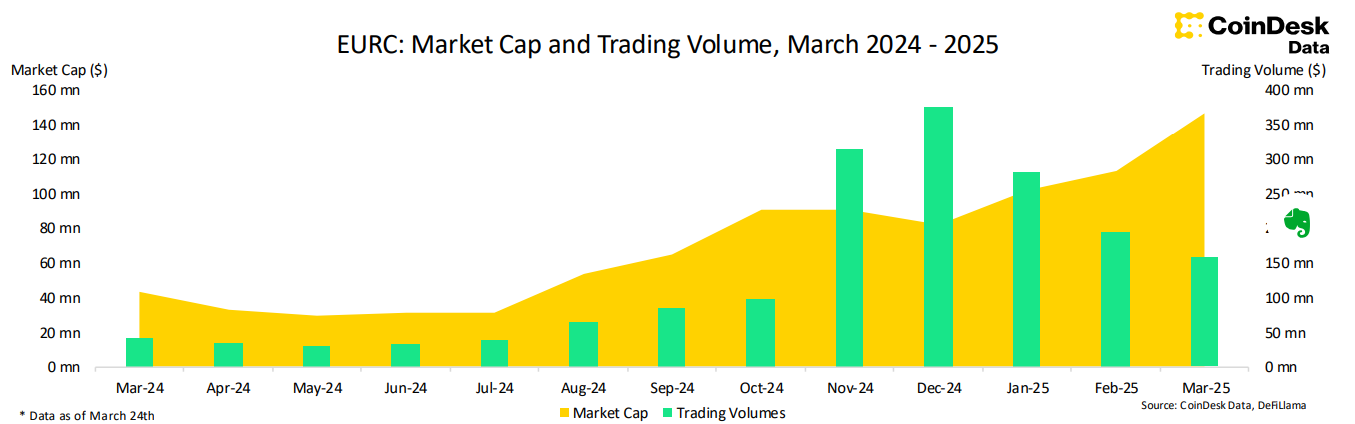

On the flip side, EURC (EURC), the euro-backed stablecoin issued by Circle, saw its market capitalization climb 29.5% to $147 million, setting a new all-time high and marking the third consecutive month of growth. This rise is largely driven by the delisting of non-MiCA-compliant stablecoins like USDT on European exchanges, prompting users and platforms to migrate to regulated alternatives like EURC. As a result, EURC now accounts for 45.6% of the total market capitalization of euro-denominated stablecoins.

The overall stablecoin market expanded, with stablecoin market cap dominance increasing to 8.02%.

Read the full article here