XRP price rallied on Wednesday after Ripple CEO Brad Garlinghouse announced that the U.S. Securities and Exchange Commission will drop its appeal in the lawsuit against the firm. XRP posted a double-digit rally following the announcement after Garlinghouse’s tweet on X.

The legal battle between the U.S. financial regulator and Ripple dragged on for several years before drawing to an end. The outcome was anticipated by crypto traders as the SEC has dropped its legal actions against crypto exchanges and firms rapidly since U.S. President Donald Trump’s return to the Oval Office in January 2025.

In this deep dive, we evaluate whether XRP is the best buy in the recent dip and what to expect from XRPLedger’s native token next week.

XRP rallied in double-digits, should you buy the dip now?

XRP rallied as traders reacted to the groundbreaking news of the SEC dropping its lawsuit appeal against Ripple. The legal battle between the two entities made headlines for several years, negatively impacting XRP price and the token’s adoption.

When the SEC filed its lawsuit against Ripple in 2020, top crypto exchanges delisted the token, causing XRP’s price to crumble. The rally in XRP on Wednesday was traders’ response to the end of a multi-year battle.

While XRP was expected to continue rallying, the token wiped out some of its gains from Wednesday at the time of writing.

XRP trades at $2.4013, down nearly 6% from Wednesday, according to price data from Crypto.news.

The technical indicators on the daily price chart signal a likelihood of gains in XRP. The altcoin could climb higher in the coming week as the volatility in crypto token prices settles. The Wednesday low of $2.2653 is the support level for XRP. A daily candlestick close under this level could signal an upcoming trend reversal in the altcoin.

Ripple lawsuit ends, CEO makes shocking announcement on X

CEO Brad Garlinghouse’s announcement of the end of the Ripple lawsuit was expected by traders but surprising to new entrants and market participants. The SEC prolonged its legal battle with Ripple for several years and dropped several crypto-related investigations and litigation in the past few weeks before ending the lawsuit against Ripple.

While Garlinghouse spoke with confidence when calling the end of the prolonged legal battle, he clarified that the commission has yet to vote on the matter and approve the decision to pull the appeal in the SEC vs. Ripple case.

There is no fixed timeline or confirmation from the U.S. financial regulator, which could be one of the key reasons for the decline in XRP price. While traders reacted positively to the news of the lawsuit’s end, the lack of an official date and SEC confirmation remains a concern. A formal announcement could ease trader concerns and pave the way for further gains in XRP.

Garlinghouse’s tweet on X was reiterated by Ripple’s Chief Legal Officer Stuart Alderoty and was well received by XRP holders and crypto traders.

XRP weekly price forecast

XRP/USDT daily price chart shows signs of further gains in the second-largest altcoin. The native token of the XRPLedger could target the $2.59 level for next week, a modest 7% gain on the current price.

XRP is likely to resume its climb soon as both momentum indicators, RSI and MACD, show underlying positive momentum in the altcoin’s price trend. RSI reads 50, at the neutral level, while MACD flashes consecutively higher green histogram bars for nearly a week now, as observed on the XRP/USDT price chart.

A drop in XRP price could see the altcoin dip to the February 3 low of $1.7711. XRP price is likely to rebound from this level, with several bullish imbalance zones in its path to recovery.

A drop in XRP price could see the altcoin dip to the February 3 low of $1.7711. XRP price is likely to rebound from this level with several bullish imbalance zones in its path to recovery.

XRP derivatives and on-chain analysis

Coinglass data shows that the long/short ratio for XRP exceeds 1 on most derivatives exchanges. This implies that derivatives traders remain bullish on an increase in XRP price. On Binance and OKX, the long/short ratio is 2.45 and 2.06, respectively.

Over $20 million in derivatives positions were liquidated in the past 24 hours, with a majority of long positions as traders bet on an increase in XRP price while the token declined on Thursday.

Derivatives data analysis shows that sidelined buyers should wait before opening a long position in XRP. Profit-taking is likely dominant while XRP holds steady above the $2.2653 support.

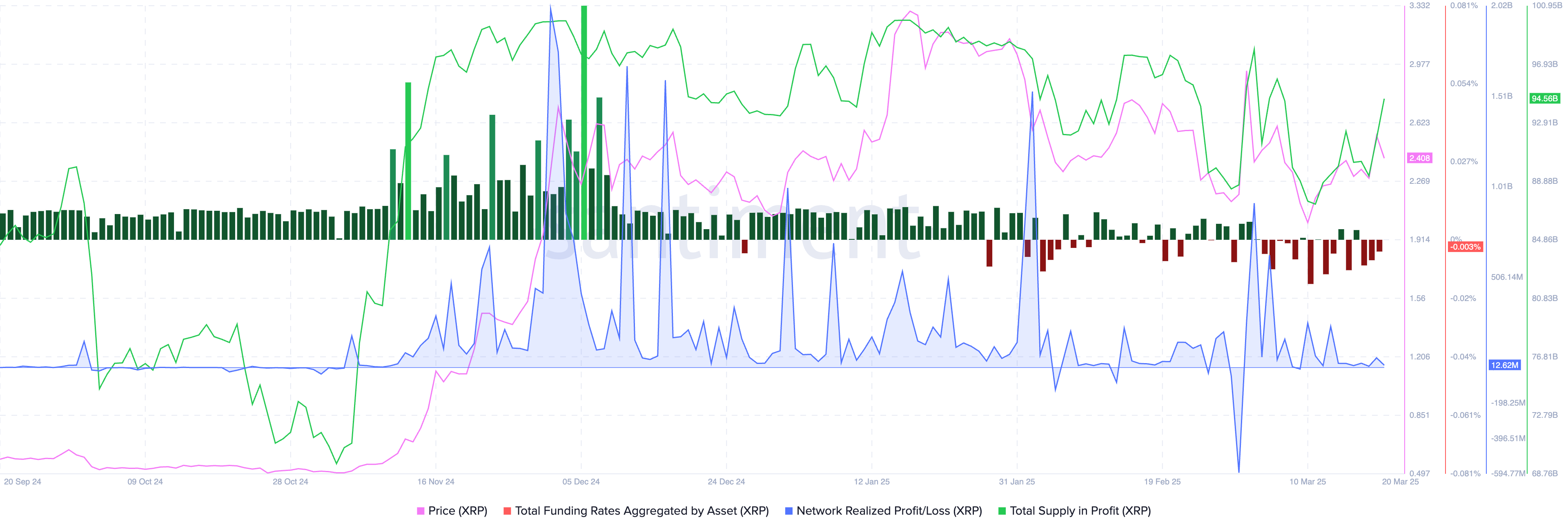

Santiment data shows that the total XRP supply in profit has spiked to 94.56 billion on Thursday, even as price takes a hit on the day. The network’s realized profit and loss metric, used to determine whether traders are taking profits on their holdings or realizing losses on all tokens moved on a given day, shows a long streak of profit-taking by XRP holders.

Typically, consistent profit-taking can increase selling pressure on XRP and negatively affect price. However, technical indicators show the likelihood of gains, meaning traders should expect volatility in the altcoin in the coming week.

Funding rates aggregated by XRP show negative funding, a bearish sign for the token. Sidelined buyers should be cautious before adding to their positions during the ongoing price dip and wait for further confirmation from technical indicators.

What to expect from XRP

With 11 different XRP Exchange-Traded Fund filings pending with the SEC, Brad Garlinghouse told crypto traders that an XRP spot ETF approval is likely by the second half of 2025. Crypto traders interpret this as the largest catalyst anticipated by traders this year since the 2024 approval of Bitcoin (BTC) spot ETFs kicked off the largest bull market in the crypto token.

Garlinghouse is bullish on two expected milestones for XRP, inclusion in the U.S. crypto stockpile and ETF approval by H2 2025. The Ripple CEO commented on this and more in his interview with Bloomberg on Thursday, March 20.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Read the full article here