Disclosure: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. By using this website, you agree to our terms and conditions. We may utilise affiliate links within our content, and receive commission.

Moscow will give Russian bailiffs more new powers to seize digital rubles and cryptoassets in bankruptcy cases.

Per Comnews, the plan is the brainchild of the Ministry of Justice and the Russian Federal Bailiff Service (FSSP).

The ministry wants to give bailiffs a range of new legal powers over the next few years.

These include the authority to use mobile phone geolocation services to locate debtors.

A Ministry of Justice spokesperson said that bailiffs will be able to execute “foreclosure” on “digital ruble, digital currencies, and digital financial assets” holdings.

Russian legal and political circles often use terms like “digital currencies” to refer to cryptoassets such as Bitcoin (BTC).

They use the term “digital financial assets” (or DFAs) to speak about a wider range of digital assets, including tokenized commodities, tokenized securities, and even NFTs.

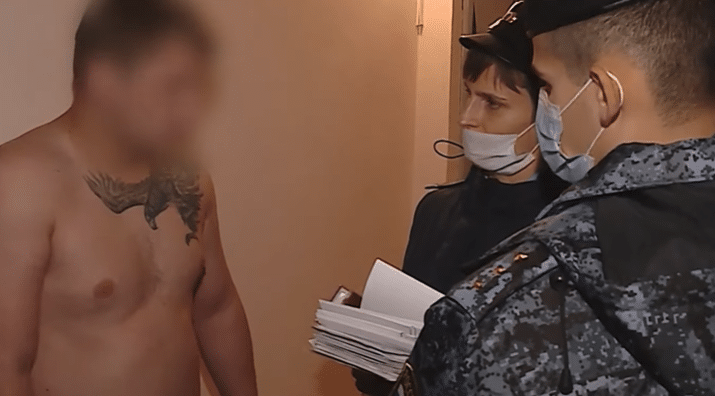

A Russian bailiff enters a building in search of a suspected debtor. (Source: GTRK Belgorod/YouTube)

Russian Bailiffs to Receive New Crypto and Digital Ruble-related Powers?

The ministry spokesperson added that the ministry also wants to authorize the “sale of seized property through electronic trading.”

This likely means that Russian bailiffs will have the right to liquidate debtors’ token holdings on crypto exchanges.

Senior politicians have suggested the creation of a state-owned crypto exchange that could oversee such sales.

They have suggested that the main function of such an exchange would be to help industrial crypto miners sell their coins to overseas buyers.

The nation’s crypto-skeptic Central Bank wants to keep cryptoassets “out of the Russian economy.”

“Russian miners will not leave the market. In September last year, #Russia ranked third in terms of [crypto] technical capacity, primarily in the #bitcoin field. This is an enormous amount of power.”

Read more 👇https://t.co/gCF4OLuX6X

— Cryptonews.com (@cryptonews) March 15, 2022

But the bank is prepared to let Russian industrial miners operate unhindered.

Another potential function of a state-run crypto trading platform would be to facilitate USD-free trade between Russian companies and overseas firms.

Again, the bank has insisted that it is happy for traders to use crypto as a payment tool.

But it insists that Russian firms must sell their coins for fiat at the earliest opportunity.

The development follows a CBDC-related announcement in July this year from the FSSP director.

The director said that the service has “been empowered to collect fines in the form of digital rubles.”

Russian bailiffs question a suspected debtor. (Source: GTRK Belgorod/YouTube)

The service chief stated that this applied to both “individuals and legal entities” operating in the nation.

Earlier this month, the nation’s largest bank claimed that overseas exchanges such as OKX had “cooperated” with the requests of Russian “arbitration managers” in bankruptcy cases.

Read the full article here