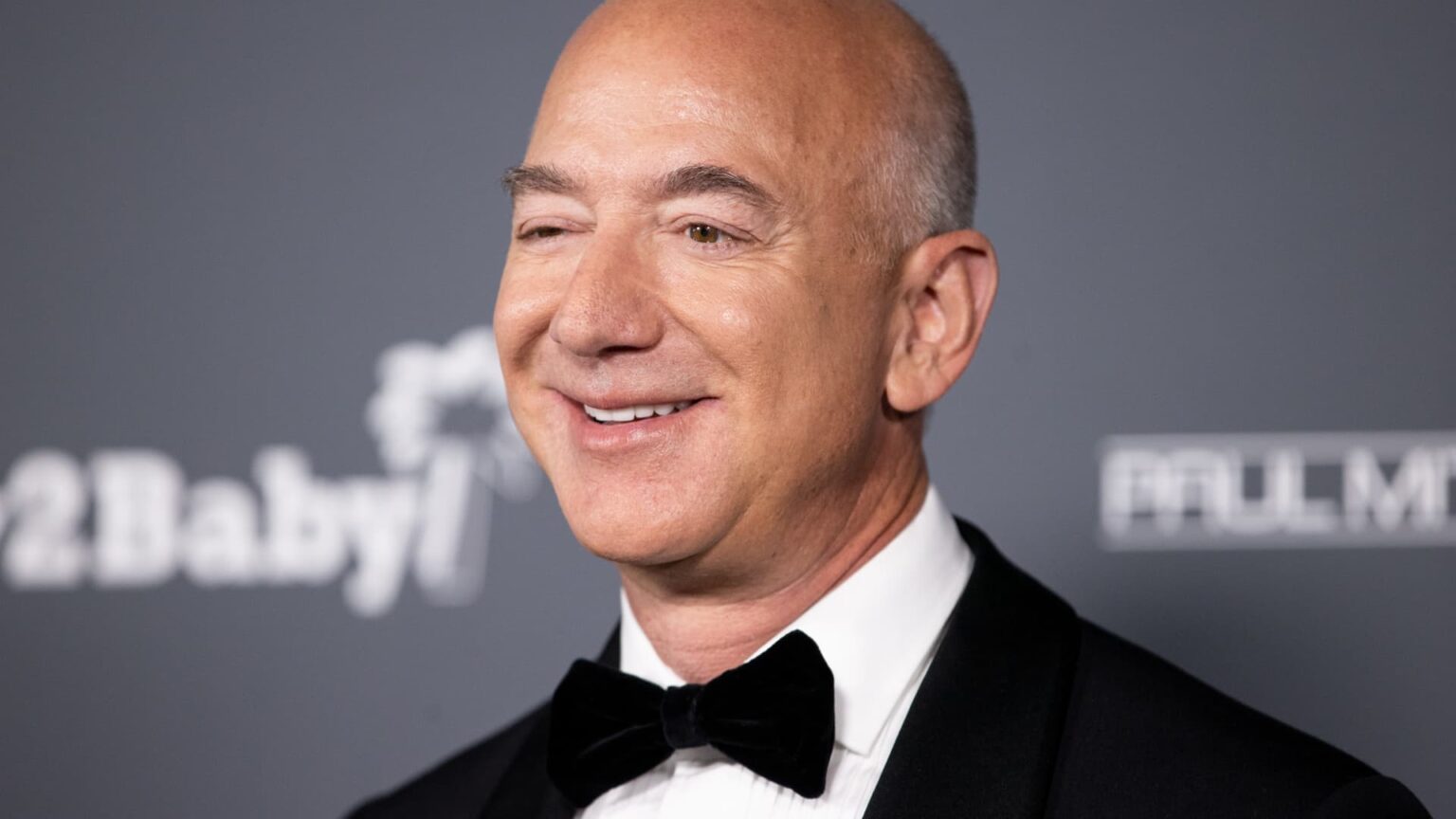

Jeff Bezos is expected to be “aggressive” in selling more shares of Amazon on Tuesday, sources told CNBC’s David Faber.

Bezos may sell as many as 8 million to 10 million shares, which would amount to more than $1 billion worth of stock, the sources told Faber.

Shares of Amazon closed down about 1.5%.

It comes after Bezos last week unloaded about $240 million worth of Amazon shares, according to financial filings. The transactions were marked as contributions to nonprofit organizations, the filing states.

It’s unclear who Bezos donated the shares to. A representative for Bezos didn’t immediately respond to a request for comment.

Bezos — who is the third-richest person in the world, with a net worth of around $170 billion, according to Bloomberg — still owns about 988 million Amazon shares, which amounts to a nearly 10% stake in the company.

Since stepping down as CEO of Amazon in 2021, Bezos has accelerated his charitable giving, and has said he plans to give away much of his fortune in his lifetime. Bezos and his fiancee Lauren Sanchez in August pledged $100 million to recovery efforts in Maui after deadly wildfires ravaged the Hawaiian island. Bezos has said he sells at least $1 billion of Amazon stock a year to fund his rocket startup, Blue Origin, and in 2020 he launched the $10 billion Earth Fund to combat the effects of climate change.

Earlier this month, the Amazon founder and executive chairman announced that he plans to leave Seattle and move to Miami, allowing him to be closer to his parents, Sanchez and Blue Origin’s operations.

WATCH: Here’s why Jeff Bezos is leaving Seattle for Miami

Don’t miss these stories from CNBC PRO:

Read the full article here