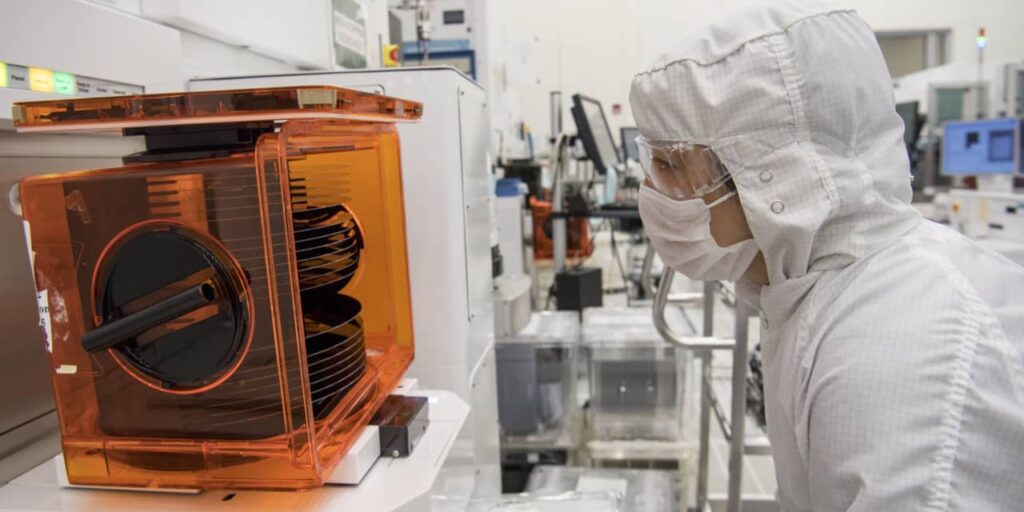

One fact about the artificial intelligence trend is that running large language models and related inference software is going to be a boon for chip demand—and that demand should trickle down to the semiconductor equipment industry.

So at least in concept, if you like ChatGPT, you should be buying shares of Applied Materials.

That is the heart of the theory proffered Wednesday by Redburn Atlantic analyst Timm Schulze-Melander, who raised his ratings on both

Applied Materials

(ticker: AMAT) and

ASM International

(ASMIY) to Buy from Neutral. He also launched coverage of

Lam Research

(LRCX) with a Buy rating, and started

KLA

(KLAC) at Neutral.

To be sure, chip makers have been slashing capacity near-term, which is never good for the equipment sector. And the analyst notes 2024 will be “a year of semiconductor capacity digestion.” But he expects the semi capital equipment sector to resume growth in 2025, driven in part by chip-demand tied to the accelerated rollout of AI applications.

Schulze-Melander thinks the chip sector is likely to see one more round of consensus estimate cuts when it reports earnings early in 2024. And he notes chip makers will see improving results ahead of the equipment companies.

His view is that “investors will be quick to look through a challenging 2024 and focus instead on the growth opportunities in 2025 and beyond.”

The analyst sees multiple positive factors falling into place, although the picture is complex. The PC end market, he says, has troughed.

He sees evidence of improvement in a recent rebound in spot prices for both NAND and DRAM memory chips, although he also notes that for now there remains substantial excess production capacity in the system. He sees PC units rebounding to 8% growth in 2024 from an estimated 11% decline this year.

For mobile phones, he sees green shoots suggesting recovering demand, in particular in China.

“China, the world’s largest smartphone market, appears to have stabilized,” he writes. “Sales of local brands are tracking more positively than expected such that suppliers are reporting rising demand across an increasing number of local handsets.”

He also sees a potential catalyst for the mobile phone segment in

Samsung’s

expected launch of the Galaxy S24 smartphone in January. Schulze-Melander projects global smartphone unit shipments to be up 4% next year, from a 5% decline this year.

The data center chip market has been weak, he notes. But he adds that early signs of an investment cycle are emerging. Meanwhile, Schulze-Melander cautions that demand only now seems to be slowing for chips used in the automotive and internet of things sectors.

For Applied Materials, his price target is $175—the stock has recently been trading for about $150. He notes the company has “the broadest range of technology offerings into semiconductor manufacturing.”

For

ASM International,

Schulze-Melander sets a price target of €545, about 100 euros above the current level. He says the company has a market-leading position in atomic layer deposition, an area he sees driven by new applications.

Schulze-Melander sets a price target of $800 on

Lam Research,

above Tuesday’s close at $707. He notes Lam has “powerful market positions in two key etch processes; conductor and dielectric.” The analyst sees Lam as a beneficiary from the chip industry’s increased adoption of “vertical scaling,” or building chips in three dimensions, not just on a flat surface.

For KLA, Schulze-Melander sets a price target of $550, a few dollars below the current level. While he says KLA is on a stable growth trajectory, he thinks the business is well understood by investors.

Applied Materials, KLA, Lam, and ASM International all traded higher Wednesday.

Write to Eric J. Savitz at eric.savitz@barrons.com

Read the full article here