(Bloomberg) — Stocks in Asia were set to decline as the rally in US benchmarks stalled after Federal Reserve minutes reiterated the central bank’s cautious approach. Nvidia Corp. slipped in late trading after investors were underwhelmed by its latest quarterly update.

Most Read from Bloomberg

Futures for equity indexes in Japan and Hong Kong pointed down, along with those for the US, while stocks in Australia opened little changed. Asian artificial intelligence stocks may also slip after Nvidia failed to meet sky-high expectations. While the world’s most valuable chipmaker posted another quarter of impressive growth, investors were anticipating more after pouring money into the stock on hopes that the AI industry would bring explosive sales gains.

US benchmarks lost steam on Tuesday after the S&P 500’s $6 trillion rally on the back of the artificial intelligence boom, Corporate America’s resilience and bets the Fed will pivot to rate cuts next year. The gains left the index about 5% away from reclaiming its all-time high.

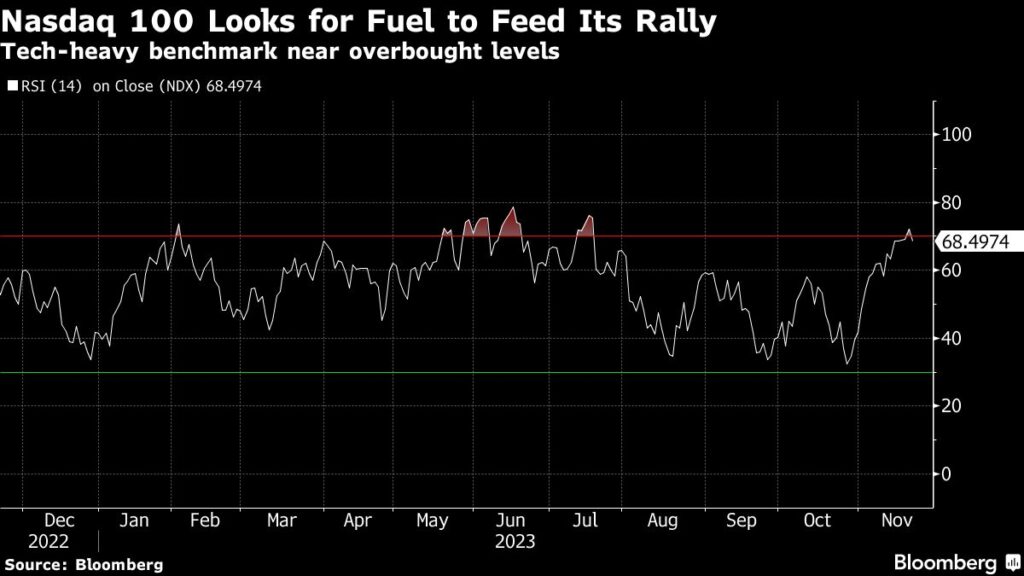

“The stock market is once again priced for perfection,” said Matt Maley, chief market strategist at Miller Tabak + Co. “Since the stock market is more ‘overbought’ right now — than it was ‘oversold’ three weeks ago — investors will need to remain very nimble as we move through the end of November and into December.”

Read: PGIM Warns Against Risk Rally as Demand Woes Mount: Surveillance

For a market surge that has been predicated squarely on the belief the central bank has completed its hiking cycle and rate cuts are due in 2024, the Fed minutes just underscored the most-recent messaging — officials are still not prepared to declare victory and they have no intention so far to ease policy, according to Quincy Krosby at LPL Financial.

“Today’s sluggish market is a more a function of a short-term overbought market, rather than a market that believes it misinterpreted the Fed,” Krosby noted. “Still, the market believes that the Fed is finished and that the economy will require help with rate cuts in 2024, regardless of the Fed’s messaging.”

Hedge funds are holding their most-concentrated wagers on US equities than anytime in the past 22 years, according to data from Goldman Sachs Group Inc. The most popular bets remain in megacap tech, with Microsoft Corp., Amazon.com Inc. and Meta Platforms Inc. in Goldman’s list of “Hedge Fund VIPs” this quarter.

To Savita Subramanian at Bank of America Corp., the S&P 500 is set for a fresh high in 2024 because US companies have adapted to higher rates and weathered macroeconomic jolts. She sees the gauge at a record 5,000 by the end of 2024. That’s about 10% higher than Tuesday’s close. Next year will be “a stock picker’s paradise,” she said.

Read: Wall Street Rally Boosts Everything From Microsoft to Small Caps

US stocks have “much more upside potential” as they approach decisive bullish breakouts, wrote BofA’s technical strategist Stephen Suttmeier. If the S&P 500 could surpass the low 4,600s, it would confirm a “bullish cup and handle” pattern from early 2022 — triggering more gains, he added.

“Our base case is for further modest equity gains in 2024, with the S&P 500 Index ending the year around 4,700,” said Solita Marcelli at UBS Global Wealth Management. “As inflation continues to fall and growth moderates, we are even more positive on quality fixed income. But an unusually wide range of risks could still spoil the outlook.”

Investors held back from a sale of 10-year Treasury inflation protected securities, with demand tempered by this month’s big rally and outflows from exchange traded funds tracking the sector.

Key events this week:

-

Eurozone consumer confidence, Wednesday

-

US initial jobless claims, University of Michigan consumer sentiment, durable goods, Wednesday

-

Bank of Canada Governor Tiff Macklem speaks, Wednesday

-

Eurozone S&P Global Manufacturing & Services PMI, Thursday

-

Thanksgiving holiday — US markets closed — Thursday

-

ECB publishes account of October policy meeting, Thursday

-

Germany IFO business climate, Friday

-

US S&P Global Manufacturing PMI, Friday

-

Black Friday, traditional kick-off for the US holiday shopping season

-

ECB’s Christine Lagarde speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.1% as of 8:13 a.m. Tokyo time. The S&P 500 fell 0.2%

-

Nasdaq 100 futures fell 0.2%. The Nasdaq 100 fell 0.6%

-

Hang Seng futures fell 0.3%

-

Nikkei 225 futures fell 0.5%

-

Australia’s S&P/ASX 200 was little changed

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The Japanese yen rose 0.2% to 148.08 per dollar

-

The offshore yuan was little changed at 7.1447 per dollar

-

The Australian dollar was little changed at $0.6558

Cryptocurrencies

-

Bitcoin fell 1.3% to $36,356.12

-

Ether fell 1.8% to $1,951.1

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Rita Nazareth.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Read the full article here