On Nov. 3, IOTA led gains among the 100 largest cryptocurrencies by market cap as developers initiated voting for the Rebased upgrade.

IOTA (IOTA) rose 46% in the last 24 hours to a six-month high of $0.504, bringing its market cap past $1.7 billion at press time. The gains extended its monthly gains to over 350% while its daily trading volume jumped 83,% hovering over $705 million at the time of writing.

The altcoin’s recent price rally was supported by a jump in futures open interest. According to CoinGlass, open interest in the futures market hit a record high of $87.89 million, up over three times from last week’s low of $26.27 million.

Why is IOTA rising?

IOTA rallied after developers opened the voting process to upgrade the IOTA L1 mainnet to the new Rebased protocol.

Rebased is IOTA’s largest upgrade to date, introducing multiple features such as the ability to earn IOTA staking rewards, an initial target inflation rate between 6% and 7%, support for deploying Move-based smart contracts, and full decentralization of the IOTA ledger.

IOTA rebased upgrade is expected to reduce transaction costs, introduce an adaptive fee-burning mechanism, and implement sponsored transactions to abstract transaction fees.

The voting process for the Rebased upgrade will last for seven days, concluding on Dec. 9, while the counting process will take an additional seven days, ending on Dec. 16.

IOTA’s rally comes as the altcoin market is gaining momentum, as evidenced by the Altcoin Season Index at 81, indicating that many altcoins are outperforming Bitcoin. This surge aligns with heightened optimism in the cryptocurrency market, with the Crypto Fear and Greed Index reaching 76, signaling strong bullish sentiment prevailing in the market.

What’s next for IOTA price?

After IOTA’s recent surge, analysts now predict more gains for the altcoin

According to pseudo-anonymous analysts Team LAMBO Charts, IOTA has broken out of a large falling wedge pattern, a bullish signal in technical analysis, and has also breached a major resistance level at $0.40.

They predict the altcoin could surge to $0.70 in the short term, followed by a rally to $1, with a much more bullish mid-term target of $2.60—which would represent a 430% hike from the current price level.

Meanwhile, another market commentator observed that IOTA has broken out after two years of accumulation. He anticipates further gains for the altcoin as whales start rotating recent profits from other altcoins into IOTA.

Sharing a three-day price chart, he predicted that IOTA could rise to $3.50, provided it successfully breaches the $1 level in the short term.

IOTA could pullback before its next move

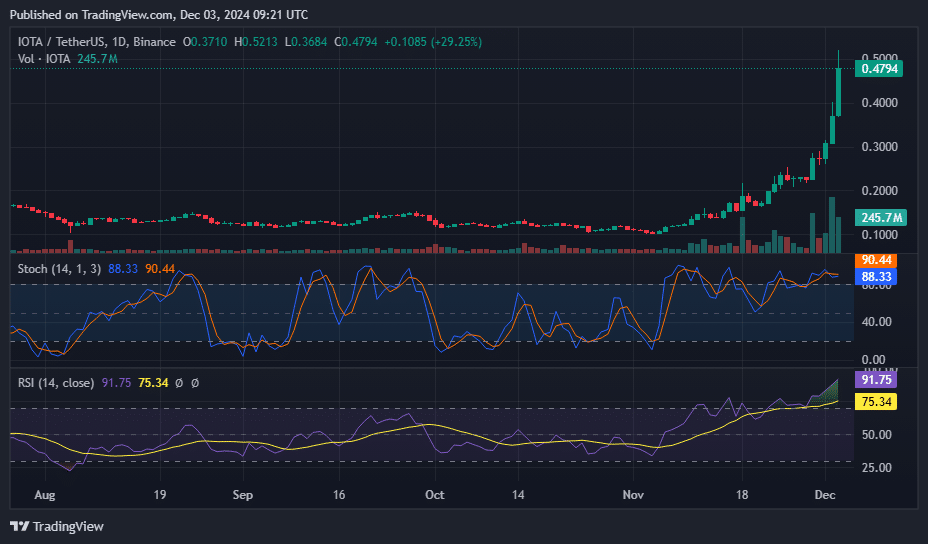

On the daily chart, IOTA has moved above both the 50-day and 200-day Exponential Moving Averages at $0.1914 and $0.1710, respectively, which have recently formed a golden cross, which can mean a major upside for the altcoin in the near future.

However, the Relative Strength Index and the Stochastic Oscillator have reached overbought levels, suggesting that a pullback is likely. Therefore, the altcoin could retreat to retest the support at $0.30 before resuming its upward rally.

The next major resistance is at $1, a level IOTA failed to breach on two consecutive attempts in 2022. A breakout above this resistance could propel the altcoin to retest $1.49, its peak from December 2021.

Read the full article here