(Bloomberg) — Europe’s investors are bracing for a potential victory for Donald Trump, which last time around drove the sharpest underperformance in regional equities relative to US peers during any of the last eight American administrations.

The protectionist policies the Republican candidate could unleash on Europe’s export-reliant industries if he defeats the Democrats’ Kamala Harris explain why some expect history to repeat itself in the stock market.

A potential Trump win is starting to get “priced in already” in Europe, said Neil Birrell, chief investment officer at Premier Miton Investors. “People are moving away from the sort of things that did less well during the last Trump” administration, he said.

While S&P 500 companies derive 72% of their sales in the US, members of Europe’s Stoxx 600 make only 40% within their own region. A chunk of the rest comes from the US, by far the European Union’s largest trading partner, with commerce amounting to $952 billion in 2023, according to data compiled by Bloomberg.

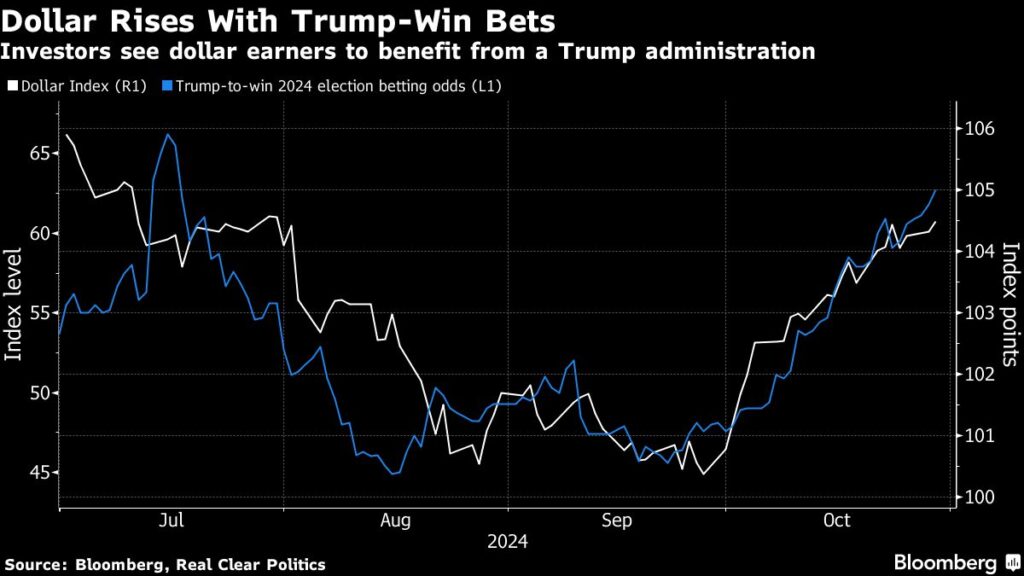

Investors are moving out of stocks geared toward Democrat policies. A UBS Group AG basket of European companies seen benefitting from the Inflation Reduction Act (IRA), and others such as renewables stocks and firms that fare best when trade relations are smooth, dropped about 10% last month. That coincides with increased wagers on a Trump win.

This list includes renewable energy companies like Vestas Wind Systems A/S and consumer-facing firms like Pernod Ricard SA and Volkswagen AG.

In contrast, stocks that UBS selected as beneficiaries of a Republican administration are on the up. They include beneficiaries of US reshoring and reflation, a rollback of the IRA, reduced US involvement in EU defense and trade tensions. Defense groups Rheinmetall AG and Thales SA, and tobacco giant Imperial Brands Plc are among these.

Here’s a look at the stocks and sectors most likely to feel the impact of a Trump victory, as well as those most exposed to Harris’s proposed measures:

Increasing duties on imports and cutting corporate taxes are the best-known aspects of Trump’s economic policy. He has proposed raising tariffs to 60% for Chinese imports and 20% for the rest of the world, sparking anxiety among European company chiefs. Aside from any direct blow, their firms could be caught in the crossfire if China were to retaliate.

“A Republican sweep would give the government the widest scope of action in implementing higher tariffs and lower corporate taxes,” Bank of America Corp. strategists led by Sebastian Raedler said in a note. “This would leave us cautious towards European sectors with high US sales exposure.”

Morgan Stanley strategists led by Marina Zavolock estimate that a hypothetical 10% universal tariff could shave around 0.3 to 0.6 of a percentage point off European growth.

In another sign of investor positioning, a Goldman Sachs Group Inc. basket of companies exposed to US tariffs has trailed peers with significant American production presence over the past year.

The tariff-exposed ranks include German carmakers Mercedes-Benz Group AG, Dr Ing hc F Porsche AG and BMW AG, beverage producers Pernod Ricard, Remy Cointreau SA and Diageo Plc, as well as industrials such as Signify NV, Legrand SA and Assa Abloy AB.

However, a Harris victory could see a relief rally for the sectors suffering the most under the tariff threats.

“If Harris wins, EU equities could see the tariff risk premium being unwound, with our trade and China exposure baskets potentially benefiting, given they are already pricing in some tariff risks,” Barclays Plc strategists led by Emmanuel Cau said in a note.

Automakers

When it comes to tariffs, European automakers merit special mention, as the Stoxx 600’s worst-performing sector this year could end up being hit hard.

Trump has pledged tax breaks for Americans buying cars, but only those made in the US. He favors steep levies on autos from Mexico and China, for instance, touting duties as high as 1,000%.

Among European manufacturers, Jefferies analyst Philippe Houchois said BMW and Mercedes-Benz are more “balanced” US producers. That’s compared with Volkswagen, which operates one of Mexico’s biggest auto manufacturing sites, and Porsche because of its import-only approach.

There’s a threat to European electric vehicle producers from any tinkering by a Trump administration with eligibility for IRA tax credits. It could get harder for EVs to get subsidies, while industries typically favored by Republicans, such as capturing carbon and making hydrogen with the help of fossil fuels, get a boost.

Renewable Energy

A complete scrapping of the IRA is seen as unlikely under Trump, given the funds that have already flowed into red states. However, his campaign against Washington’s “green new scam,” as he has dubbed the IRA, has put the offshore wind industry in his sights.

UBS analysts say the election outcome will be key for sentiment toward stocks like Denmark’s Orsted A/S. The sector could come under pressure if Trump were to pause new project approvals.

“Given risks to offshore wind in the event of a Republican presidency we think Orsted shares could be negatively impacted on the day,” analyst Mark Freshney said in a note.

Another stock in focus is Portuguese wind energy producer EDP Renovaveis Sociedad Anonima. Citigroup Inc. analyst Jenny Ping said the company’s results will look “insignificant” as a share-price driver compared to the election result.

“Should Trump win, we believe EDPR’s shares could take a sentiment hit,” Ping said in a note.

The flipside is that companies exposed to fossil fuels could get a boost. Oddo BHF strategist Thomas Zlowodzki said that Trump’s more inflationary policies would benefit sectors like oil and oil services stocks, such as majors BP Plc, TotalEnergies SE and Repsol SA.

Defense

European defense companies like BAE Systems Plc, Rheinmetall and Thales could also be in focus following reports that advisers for Trump have considered demanding NATO allies spend more on defense.

BofA strategists see a possible benefit if Trump were to ratchet up the pressure on NATO members to do this.

Likewise, defense stocks could be sensitive to any newsflow on Ukraine, given Trump has said he would look to end the war by calling Russian President Vladimir Putin in the days after he was elected to strike a deal. Harris has ruled out one-on-one talks with Putin.

Still, some urge investors to look beyond the political noise, and focus instead on how companies are pursuing their strategies, rather than the election outcome.

“Our overarching message to clients is that the business cycle, the innovation cycle, the earnings cycle — these are a lot more important drivers to stock markets than who is in the White House over the medium to long term,” said Frederique Carrier, head of investment strategy for RBC Wealth Management. “But having said that, elections can cause some volatility.”

–With assistance from Sagarika Jaisinghani.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.