Este artículo también está disponible en español.

Dogecoin (DOGE) has been trading below a key resistance level at $0.143 since October 19, and anticipation is building among investors who believe a breakout may be imminent. The popular memecoin has remained relatively steady, yet this critical level has prevented DOGE from moving significantly higher.

Top analyst and investor Ali Martinez recently shared a technical analysis on X, highlighting the potential for a strong rally once DOGE clears this barrier. According to Martinez, a break above the $0.143 mark could trigger a rapid 25% rally, propelling Dogecoin to fresh highs.

Related Reading

As market sentiment appears cautiously optimistic, all eyes are on Dogecoin’s performance in the coming days. Investors and traders are watching closely, expecting a decisive move that could set the stage for Dogecoin’s next trend. With the entire crypto market poised for potential shifts, it could be crucial for DOGE to regain momentum.

The outcome of this resistance test will likely play a key role in shaping Dogecoin’s path forward, especially if it ignites renewed interest and buying pressure across the market.

Dogecoin Price Starting To Rise

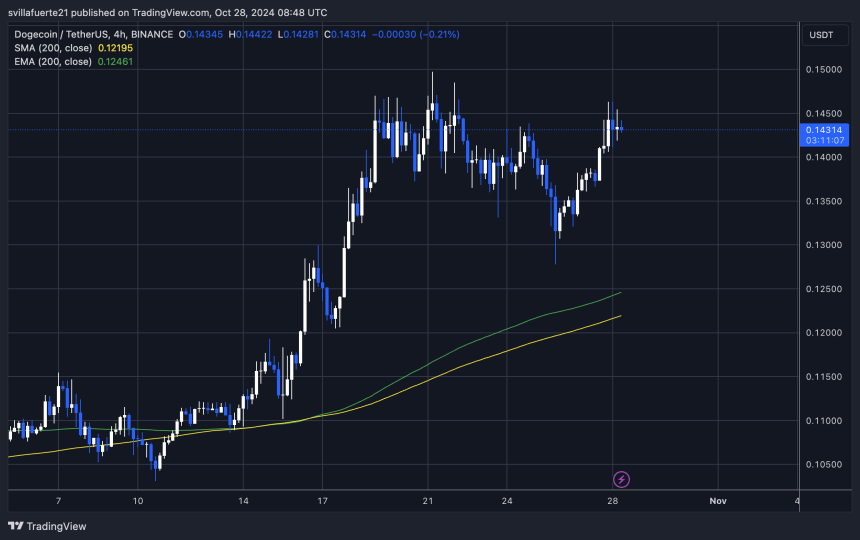

Dogecoin is showing renewed strength following a week marked by volatile price action, which included a pullback from a recent local high at $0.149. Now trading near a key resistance level at $0.143, Dogecoin is capturing attention across the market.

Prominent analyst Ali Martinez shared a detailed technical analysis on X, suggesting that if DOGE successfully breaks through this resistance, it could trigger a notable 25% rally, pushing the price up to the $0.175 mark. According to Martinez, the $0.143 threshold is crucial for Dogecoin’s short-term trajectory, acting as a potential launchpad for further gains.

Currently, Dogecoin is testing this pivotal level, and market sentiment is growing optimistic about a breakout, especially as other assets signal readiness for upward movement. The next few days will be critical, with analysts expecting potential bullish momentum across the crypto market that could support DOGE in surging higher.

Related Reading

However, should Dogecoin fail to surpass the $0.143 resistance, a period of retracement would likely be necessary to locate lower demand and restore liquidity for the next leg up. A pullback to gather momentum could provide the foundation needed to reattempt a breakout, positioning DOGE for further gains once market conditions align. As Dogecoin teeters on this critical threshold, it’s clear that the outcome of this resistance test will be instrumental in setting the tone for its price action in the near term.

DOGE Technical Levels To Watch

DOGE is trading at $0.143 after a minor rally from recent lows at $0.127. This level has proven to be a significant resistance point, as DOGE faces challenges in breaking above it. The overall market is signaling potential upward momentum, but for DOGE to maintain its bullish trajectory, it must decisively break past this $0.143 threshold in the coming hours. Successfully doing so would solidify support for a continued rally, potentially driving the price higher in the short term.

However, a retracement would likely be necessary if Dogecoin struggles to hold above this resistance. In this case, a dip to a lower demand level around $0.12 could provide the necessary liquidity to reignite buying interest and gather momentum for a subsequent push. This demand zone has previously acted as strong support and could be the fuel DOGE needs to sustain its bullish outlook.

Related Reading

As Dogecoin tests these critical levels, traders closely monitor its movements to gauge whether it can break through resistance or if a temporary pullback is on the horizon.

Featured image from Dall-E, chart from TradingView

Read the full article here