Ethereum’s price has been consolidating over the past few months, showing neither bullish nor bearish intentions. Yet, things might be about to change soon.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

On the daily timeframe, the price was trapped inside a large symmetrical triangle pattern, and both the higher and the lower boundaries were tested several times.

The future direction of the market relies heavily on whether the market breaks out of the pattern to the upside or the downside. Meanwhile, the RSI also shows values of around 50%, which indicates a state of uncertainty in the market.

The 4-Hour Chart

Looking at the 4-hour chart, it is evident that the asset has recently broken below the $2,500 level. However, it is currently retesting that line, and if it can break back above, a rally toward the $2,800 resistance zone would be highly probable.

On the other hand, a rejection could lead to a further decline toward the $2,300 support level. Yet, judging by the RSI and its increasing values, the momentum is shifting bullish, and the scenario toward $2,800 seems more probable.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

Ethereum Exchange Reserve

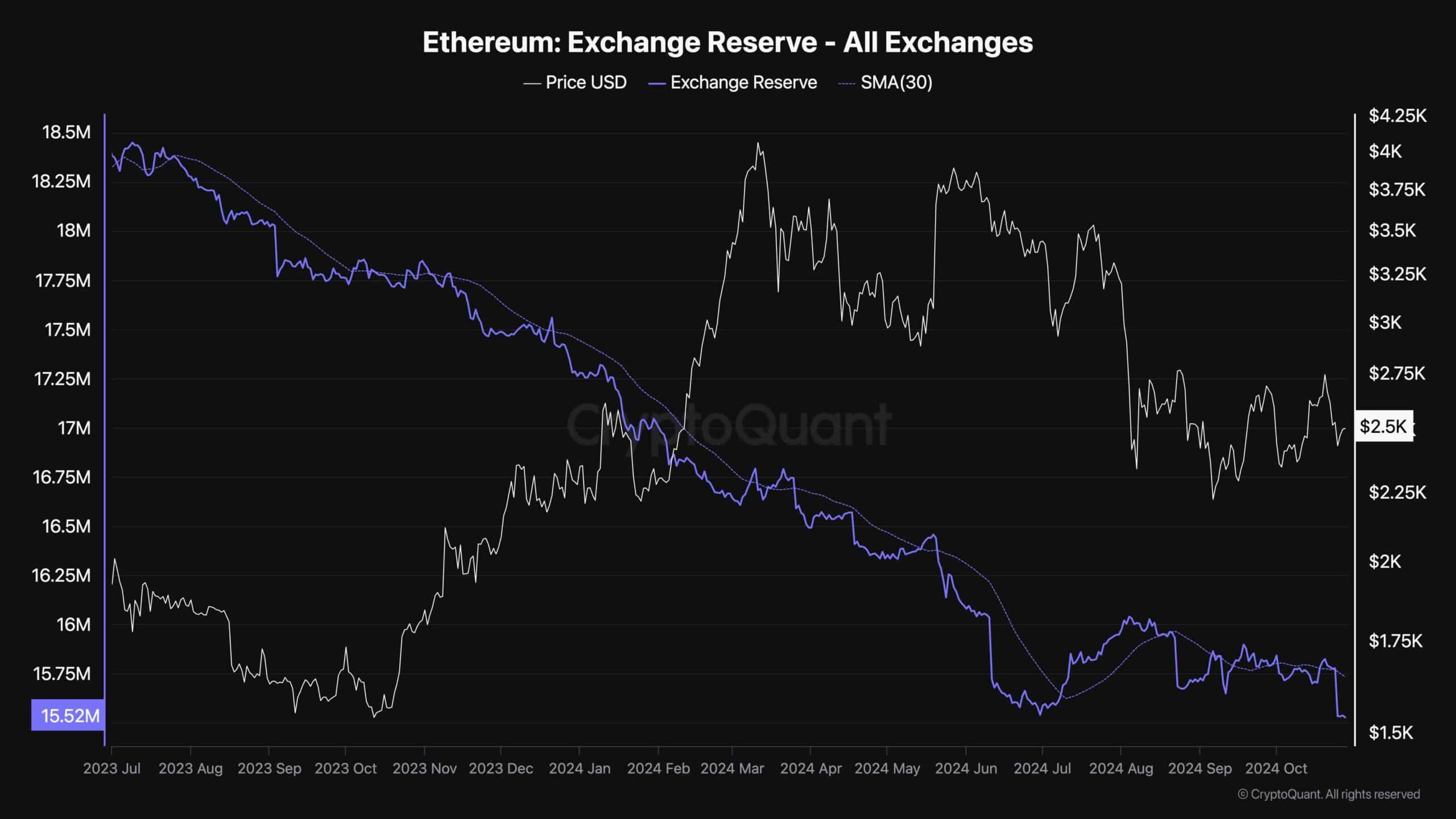

While the price chart has been consolidating, investors wonder whether a period of accumulation or distribution has been going on. Analyzing the exchange reserve metrics in this situation can be beneficial.

The exchange reserve metric measures the amount of ETH held in exchange wallets. As the chart suggests, the exchange reserve has been gradually dropping recently, with a significant decline occurring in the last few days. This points to an aggregate accumulation in the spot market, which could lead to a supply shock and rally higher if the futures market remains stable.

The post Ethereum Price Analysis: Critical Moment for ETH as it Fights for $2.5K appeared first on CryptoPotato.

Read the full article here