- Expedia stock rose as much as 7% while Uber stock fell up to 3% on Thursday.

- Uber spoke with advisors about a potential takeover in recent months, The Financial Times reported.

- The ride-hailing company wants to become a “super app” offering much more than trips and food.

Expedia stock jumped as much as 7% on Thursday, while Uber tumbled up to 3%, following a report the ride-hailing giant recently explored a takeover of the travel group.

Uber met with advisors in recent months to discuss whether an Expedia acquisition would be feasible and how it might be structured, The Financial Times reported late Wednesday, citing three sources familiar with the talks.

A third party raised the idea of buying Expedia to Uber, sources told the FT, adding that merger talks were nascent and a deal might not materialize. One source told the newspaper that Uber hasn’t formally approached Expedia, and there were no ongoing discussions between the two companies.

Expedia, which owns the eponymous travel-booking website as well as Hotels.com and Vrbo, would be Uber’s biggest acquisition. The company’s market value rose to over $20 billion early Thursday, less than one-eighth of Uber’s $168 billion valuation.

The flights-and-hotels specialist generated close to $13 billion of revenue and just over $1 billion of operating income last year, as more than 350 million room nights were booked using its platforms.

Uber posted $9.9 billion of revenue and $652 million of operating income in 2023, as users booked more than 2.6 billion trips.

A merger would contribute to Uber’s ambition of becoming a “super app.” Previous acquisitions such as Postmates and Transplace have allowed it to offer car, plane, train, and boat rides on its platform, as well as restaurant and grocery delivery. It has also moved into corporate logistics and advertising.

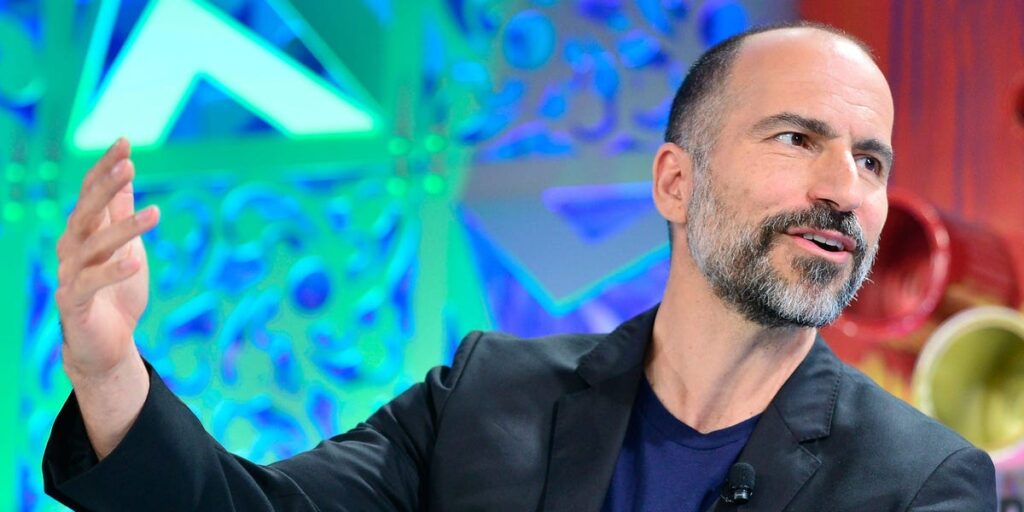

Notably, Uber CEO Dara Khosrowshahi ran Expedia between 2005 and 2017 and remains a non-executive director, suggesting any deal would likely be friendly rather than hostile.

Read the full article here