Este artículo también está disponible en español.

XRP is currently testing a crucial resistance level that will shape its price action in the coming weeks. After the euphoria surrounding the Federal Reserve’s interest rate cuts in late September, the market is experiencing uncertainty and anxiety. While some investors remain optimistic, the recent price movements of XRP have led to a sense of caution.

Top crypto analyst Amonyx has shared insights into the potential for an unexpected XRP rally. In his analysis, he suggests that the altcoin might surprise skeptics with gains surpassing 1,000%. According to Amonyx, this resistance level could be a launching pad for XRP if the price breaks above it.

Related Reading

With significant market fluctuations, investors are keeping a close eye on XRP’s ability to hold above key price points. The anticipation surrounding XRP’s future has created a mix of hope and skepticism as traders weigh the possibility of a breakout against the risks of a further decline.

As XRP continues to navigate this critical juncture, all eyes will be on its performance to determine the next steps for this altcoin.

XRP Analyst Sets Optimistic Targets

XRP is at a turning point as analysts await a signal that could propel its price higher amidst market uncertainty.

Top analyst and investor Amonyx recently shared a compelling technical analysis on X, offering an optimistic outlook for XRP’s future. His analysis features a chart illustrating a potential ascending bull pennant pattern that has been forming since June 2018. This pattern suggests a buildup of buying pressure, signaling that XRP may be poised for a breakout.

If XRP successfully breaks above the resistance defined by this bullish pattern, Amonyx predicts a remarkable surge in price, potentially targeting levels as high as $70 and even $500. While these predictions are ambitious, they underscore the market’s inherent volatility and the potential for dramatic price shifts.

Amonyx points out a critical factor influencing market sentiment: many investors believe XRP is unlikely to rise again. This prevailing skepticism may set the stage for a significant upward movement, as market psychology often plays a crucial role in price dynamics.

Related Reading

In the coming weeks, all eyes will be on XRP as traders assess whether this anticipated breakout will materialize, potentially changing the narrative for the altcoin and its investors.

Technical Analysis

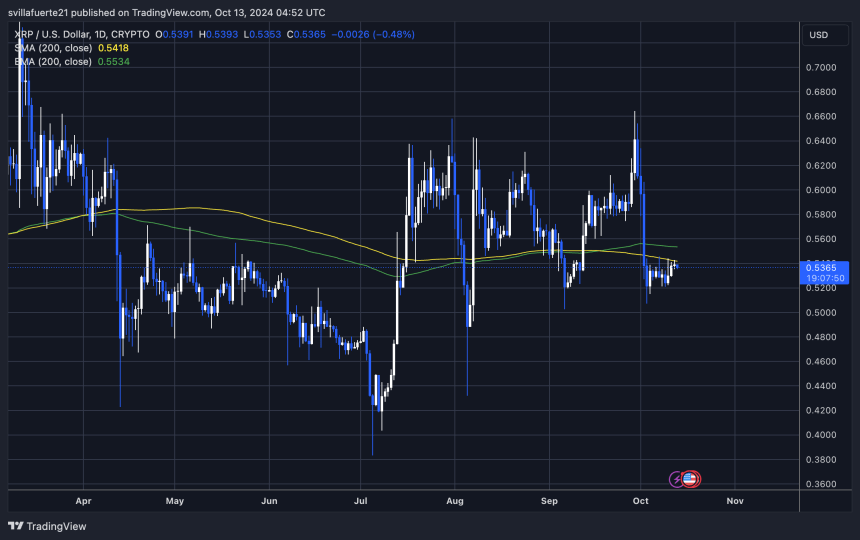

XRP is currently trading at $0.53, having recently lost both the 1D 200 moving average (MA) and the 200 exponential moving average (EMA). The price is struggling to close above the MA, which is $0.54. For bulls to regain momentum, XRP must surge past these levels to retest local highs around $0.66.

However, if the price fails to secure a close above the MA and EMA, a deeper correction could be near. Analysts are closely monitoring this critical juncture, as a breakdown below $0.53 could lead to further declines, potentially targeting support levels around $0.48 or lower.

Related Reading: Solana (SOL) Path To New Highs: Analyst Eyes $160 As Critical Breakpoint

As traders watch for confirmation of either a bullish reversal or a bearish continuation, XRP’s price action will be pivotal in shaping market sentiment in the coming days.

Featured image from Dall-E, chart from TradingView

Read the full article here