DePIN deserves the hype. Projects in the space are creating technologies that stand to change, at least to a degree, the reigning cloud computing model, while providing users with sustainable economic incentives to uphold the networks. This could be the basis for new models of economic development.

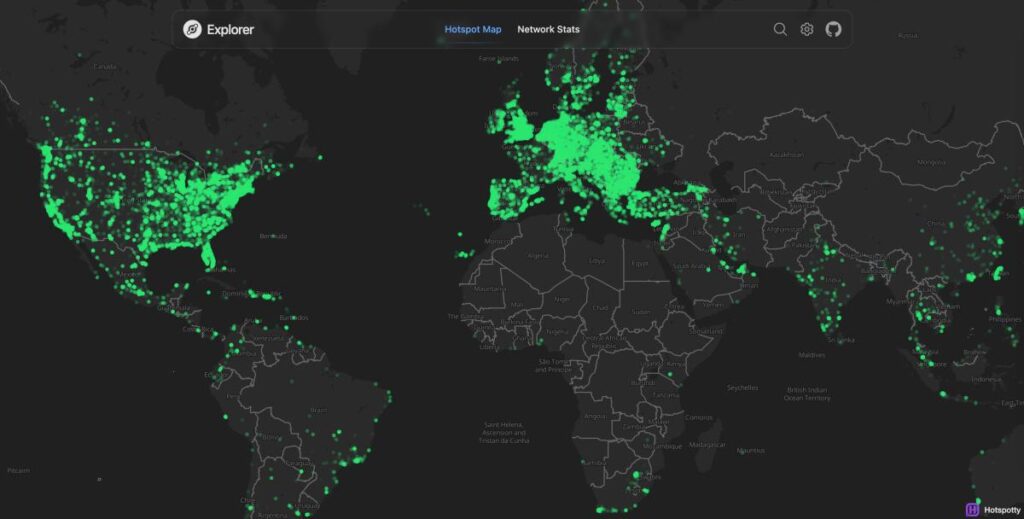

The decentralization of cloud computing is the creation of a two-sided marketplace. Node networks, the most common infrastructure underpinning DePIN projects, are an efficient and secure way for users to actually own parts of the network.

This op-ed is part of CoinDesk’s new DePIN Vertical, covering the emerging industry of decentralized physical infrastructure.

Physical assets like telecom infrastructure or video streaming networks can be divided up, apportioned and owned by node owners for a small profit. Users then pay to access that network that is sustained by the many, instead of owned by the few.

We need to consider the importance of node operators to a local economy and local innovations. DePIN networks might actually enable the little guy to win, for once.

For example, Helium’s network is being deployed for livestock tracking in Africa, helping to protect endangered species while supporting farmers’ livelihoods. Helium CEO Abhay Kumar CEO noted that: “The cow in this case, or the livestock in this case, is sort of the center of the economy for this community.”

Indeed, this is a local innovation born from DePIN.

In the emerging markets, physical infrastructure is unreliable or even nonexistent. Those markets therefore stand to be the first mover of mass adoption of decentralized networks of nodes. This is because nodes can be a small business, akin to operating a produce stall or a bicycle repair shop.

So we need to think of nodes as “micro businesses franchises” rather than an immediate cypherpunk global revolution in radical decentralization.

DePIN is not a crypto gimmick; it’s actually a small business for node operators

New ideas take time. Yet, technology is often adopted much faster in the emerging markets. Banking adoption in Africa skipped internet banking and went straight to mobile banking. Localized innovations meant African payments and credit business models emerged.

This is how we should think about DePIN, a slow revolution that the big tech giants won’t see coming as it emerges gradually through various local drivers in certain geographies. Drivers such as the utility of operating a computing node as a small business.

The DePIN supply-side business model is already slowly changing how we think about ownership of physical infrastructure networks. Still, on the demand side for Westerners this might not yet be a revolutionary moment. I’ll just stick with Zoom or Telegram and rely on AWS Cloud, thanks. Just a side hustle for Western node operators, this could be a personal finance game changer for node operators in emerging markets.

Running cloud computing nodes for a modest profit is not a gimmick or a crypto quirk, but rather it is a very viable economic engagement that, in turn, provides localized value in the form of strong and reliable networks for users.

Just think about a node operator in Bangladesh who sells cloud storage space to local users and businesses who need better and more reliable service. The businesses will pay less than by using AWS and the node operator can perhaps live off the income derived from that node. In theory, everyone in this scenario wins.

New ideas will start in the emerging markets

Most importantly, DePIN technology will also lead to new and innovative business models AWS cannot replicate.

Cheaper local nodes will create more local start ups, driving localized development and promoting ownership. The emerging markets will influence new business models, based on operating nodes for a modest profit.

Further distance education, streaming, gaming and healthcare can all be improved by better internet services. AWS won’t solve these problems: locals facing local problems will.

Nodes can feed a family, but more importantly, they can fund human capital. The person working a menial job, by owning a node, might have enough income now, to have the luxury of time to create new things, new ideas, new localized businesses based off of the learnings from running a node.

DePIN addresses more than lags, it’s a catalyst for global innovation

However, while this revolution starts in the emerging markets, innovation will sprout everywhere.

Latency issues, or lags and glitches, in the emerging markets hinder innovation. But, in truth, they hinder productivity everywhere.

DePIN means that nodes can be localized — for better internet — not just in India, but even in dense cities like New York City. The close proximity of Huddle01 nodes in New York, for example, already means that latency can be lessened and even outperform big tech. New ideas will also emerge in NYC and beyond from better internet speeds.

So the real question is what new business models can be created by DePIN? Like the early days of internet super-apps in China, fintech innovations in Africa, what innovations will node operators in India create?

We are in DePIN to support that human capital. It’s exciting, and it’s early. But DePIN node operator “micro franchise programs” – or whatever we call them next – can be a dynamo for local economic development, and for humanity.

Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc. or its owners and affiliates.

Read the full article here