Delta Air Lines expects to grow earnings in the fourth quarter, thanks to resilient travel demand and strong bookings for year-end holidays.

The Atlanta-based carrier on Thursday forecast fourth-quarter adjusted earnings of $1.60 to $1.85 per share, compared with Wall Street estimates of $1.71, according to LSEG, and above the adjusted $1.28 per share it reported a year earlier.

Revenue will likely rise between 2% and 4% from a a year earlier, compared with estimates of a 4.1% increase. The carrier warned it expects a 1-point revenue hit from lower demand before and after the Nov. 5 U.S. presidential election.

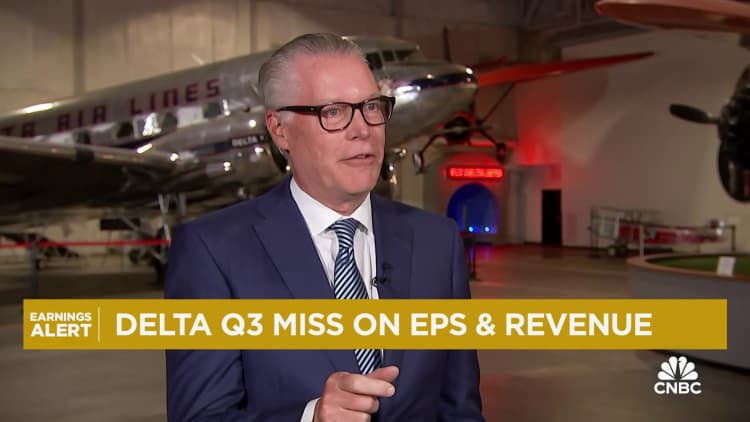

“We do anticipate seeing a little choppiness around the election, which we’ve seen in past national elections,” CEO Ed Bastian said in an interview. “Consumers will, I think, take a little bit of pause in making investment decisions, whether its discretionary or other things. I think you’re going to hear other industries talking about that as well.”

He added that holiday bookings are very strong.

Here’s how Delta performed in the third quarter, compared with Wall Street expectations based on consensus estimates from LSEG:

- Earnings per share: $1.50 adjusted vs. $1.52 expected

- Revenue: $14.59 billion adjusted vs. $14.67 billion expected

Delta reiterated that the CrowdStrike outage in July amounted to a 45-cent hit to adjusted earnings, which came in at $1.50 per share, slightly below analyst estimates. Delta struggled to recover after the outage, which took thousands of Microsoft Windows machines offline, and prompted the airline to cancel thousands of flights. The incident was a $380 million hit to revenue, Delta said.

Bastian has said Delta is seeking compensation from CrowdStrike and Microsoft from the outage.

“The havoc that was created deserves, in my opinion, to be fully compensated for,” he told CNBC. “This matter is now in the hands of our attorneys. We hope that we’ll see a resolution but we keep all of our options open.”

Still, Delta’s net income rose 15% from a year earlier to $1.27 billion in the three months ended Sept. 30, with total revenue up 1% to $15.68 billion. Passenger revenue was steady from last year, but sales from premium offerings like first class continued to outpace the main cabin.

An oversupplied domestic market had kept a lid on airfare but Delta’s president, Glen Hauenstein, said the airline “industry supply growth continues to rationalize, positioning Delta well in the final quarter of the year and as we move into 2025.” The carrier plans to expand capacity 3% to 4% in the fourth quarter.

Delta said it still expects its full-year adjusted earnings to come in between $6 and $7 a share, excluding the CrowdStrike impact.

Read the full article here