We talk about the digital economy, or the consumer economy, and even sometimes about the manufacturing sector – but the truth is, these are all interrelated and cannot be fully atomized. The glue that holds them together is the transport sector, the unsung transportation companies that move people and goods wherever they are wanted and needed.

This is big business. According to Mordor Intelligence, the US freight and logistics sector will total more than $1.33 trillion this year, and reach $1.67 trillion by the end of the decade. While freight and transportation stocks are vulnerable to cyclical changes and headwinds – demand can be fickle, consumer desires can change – there is always a need for freight and transport services.

Indeed, Citi analyst Ari Rosa is telling investors that the transport sector is primed for gains going forward, writing in a recent note: “We believe select Transportation and Logistics stocks are well-positioned to deliver strong relative outperformance in the year ahead. This view is supported by our analysis that suggests the cyclical downturn in transports is in its late stages, with rates and margins near trough, offering the prospect of strong earnings growth in 2025 and into 2026 as rates recover…”

“In our view,” adds Rosa, “investors should be positioned for a cyclical recovery, with attractive opportunities in companies that are leveraged to realize outsized benefits as freight conditions tighten.”

With this outlook in mind, Rosa has pinpointed two top transportation stocks for investors to keep an eye on. Using the TipRanks database, we’ve taken a deeper dive to assess whether these picks truly hold up.

JB Hunt (JBHT)

First on the list is JB Hunt, the $16.8 billion trucking and logistics firm founded in Arkansas back in 1961. Today, JB Hunt is the 12th largest transport company, of any type, in the US – and one of the five largest trucking companies. The company has brought a 21st-century business approach to the trucking sector, investing heavily in its people, its technology, and its transport capacity to build out North America’s most efficient transport network.

JB Hunt offers a wide range of trucking and transport services, including intermodal freight, moving containers from rail to truck and truck to rail; dedicated trucking, offering contract fleet services to enterprise customers; full truckload and less-than-truckload shipping and contract shipping services; and even ‘last mile’ delivery. These are the mainstays of the trucking sector, making freight delivery scalable, flexible, and timely – and JB Hunt has proven expertise at all of them.

This past August, JB Hunt made an announcement that shows both its competence and its commitment to technological advancement. The company announced that its autonomous delivery endeavor, a joint venture with Kodiak Robotics, had surpassed the milestone of 50,000 long-haul autonomous trucking miles, delivering Bridgestone tires between South Carolina and Dallas, Texas. The autonomous technology is used on the 750-mile stretch of the route between the cities of Atlanta and Dallas and takes approximately 16 hours of driving time.

On the financial side, the most recent quarterly showing covering 2Q24 was a bit of a disappointment. The top line reached $2.93 billion, down 7% year-over-year and missing the forecast by $100 million, while the bottom line of $1.32 in EPS was 19 cents below expectations.

The lackluster performance has not helped the stock, which is down by 16% year-to-date. Nevertheless, Citi’s Ari Rosa sees the stock as a solid value proposition, with potential for future gains. Rosa writes, “JBHT’s share price has pulled back sharply in 2024 with the opportunity for Street earnings revisions upward as volumes inflect. The company has been among the most consistent carriers to demonstrate growth through cycles. Its expanded partnership with BNSF over the last few years and decisions from competitors KNX and SNDR to shift their intermodal partnerships to UNP suggest opportunity/room for volume growth for JBHT.”

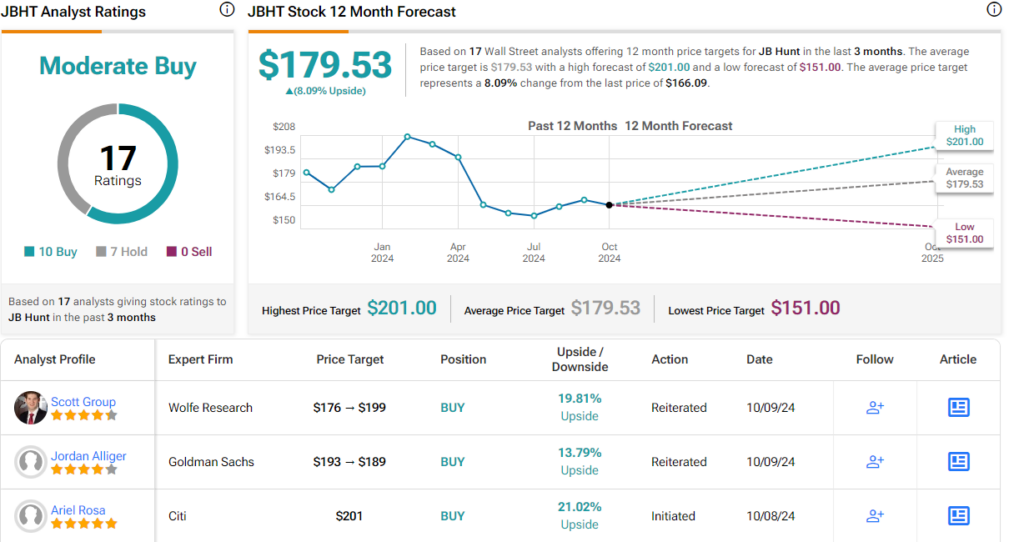

Quantifying his stance, the analyst puts a Buy rating on the shares, with a $201 price target that implies a one-year gain of 21%. (To watch Rosa’s track record, click here)

Overall, JB Hunt stock holds a Moderate Buy consensus rating from the Street, based on 17 reviews that break down 10 to 7 favoring Buy over Hold. The stock’s $166.09 trading price and $179.53 average target price together indicate an 8% upside for the coming year. (See JBHT stock forecast)

Saia, Inc. (SAIA)

The second transport stock on our list is Saia, a trucking company founded in 1924 in Louisiana – and today operating across much of the continental US, as a leader in the less-than-truckload (LTL) shipping segment. The company boasts close to 60,000 ZIP codes in its covered delivery area, and offers next-day service up to 600 miles distant, with two-day deliveries covering up to 1,200 miles. Saia can even offer cross-border shipments into Canada and Mexico, as well as shipments to Alaska and Puerto Rico.

Saia can adapt its delivery services to customers’ idiosyncratic needs. The company can provide expedited deliveries, outside of business hours, and can accommodate pickups and deliveries from multiple vendors for single customers. On-demand housing and network pooling points allow for the best possible freight rates, and streamlined delivery direct to distribution points allows customers to move their products to market faster. The company will also handle customs clearance solutions at border crossing points.

In August, Saia made some important moves to expand its network, opening 6 new terminal points in the western US. These new terminals include two each in South Dakota, Montana, and Wyoming, and together will enhance Saia’s ability to move LTL loads across the wide spaces of the West.

Saia will release earnings for 3Q24 later this month – but a look back at Q2 may be informative. Like Hunt above, the company missed the forecasts on both revenues and earnings in Q2 – the top line of $823.2 million was $1.79 million below expectations, and the bottom line of $3.83 per share missed by 18 cents. At the same time, the company’s revenue was up by 18.5% year-over-year – and earlier this month the company reported solid year-over-year gains in shipping quantities for the third quarter to date.

In his coverage of Saia, Citi’s Rosa notes the company’s solid advantages in its segment, saying of the shipper, “SAIA is arguably the carrier best positioned to match the performance of best-in-class LTL operator ODFL, in our view. We note that customer surveys show that SAIA is among the lowest-priced LTL carriers while offering above-average service performance, providing runway for pricing gains. As SAIA’s service metrics continue to improve, we think this will be an ongoing tailwind to price to drive meaningful incremental margins. SAIA’s planned expansion of its service center network creates a natural runway for growth and opportunity for improved density/efficiency.”

Rosa goes on to rate SAIA as a Buy, with a $518 price target that suggests an upside of 15.5% on the one-year horizon.

The Moderate Buy consensus rating on SAIA is based on 13 reviews that include 9 Buys, 3 Holds, and 1 Sell. The shares are priced at $447.83, and the $461.92 average price target indicates a modest 3% gain ahead in the next 12 months. (See Saia’s stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Read the full article here