(Bloomberg) — Hedge funds sold a record amount of Chinese shares on Tuesday after a weeklong holiday that lacked more major stimulus, according to a Goldman Sachs Group Inc. trader note.

Most Read from Bloomberg

“Hedge funds not only unwound their long positions but added shorts to their books as well, with long sells being double the amount of short sells,” according to the note dated Thursday.

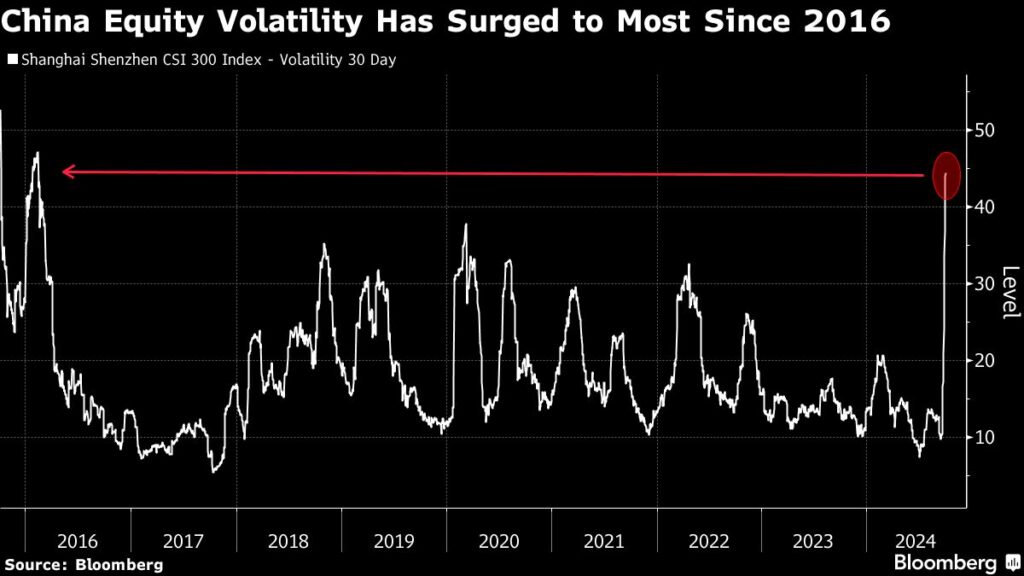

The biggest-ever daily withdrawal by hedge funds added to volatility in the market on Tuesday, as traders returned from the Golden Week holiday. The National Development and Reform Commission’s failure to deliver on market expectations for more major stimulus led to wild swings and record turnover on the mainland as well as in Hong Kong.

The CSI 300 Index started up 11% on Tuesday, then nearly erased those gains and ended up closing 5.9% higher. In Hong Kong, small losses snowballed into a 9.4% drop. Three-quarters of hedge funds’ selling was in A-shares, with the remainder Hong Kong-listed stocks, the Goldman note said.

Hot money’s selling stands in contrast to growing optimism about Chinese equities, with Beijing’s recent stimulus blitz causing a flurry of upgrades from global strategists including those at BlackRock Inc. and Goldman Sachs. The CSI 300 remains more than 25% above a low reached in September even as volatility has increased.

Traders now await the outcome of the government’s planned briefing on fiscal policy due Saturday.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here