(Bloomberg) — Chinese stocks rebounded amid bets that the government will unveil fresh fiscal stimulus at a planned Saturday briefing.

Most Read from Bloomberg

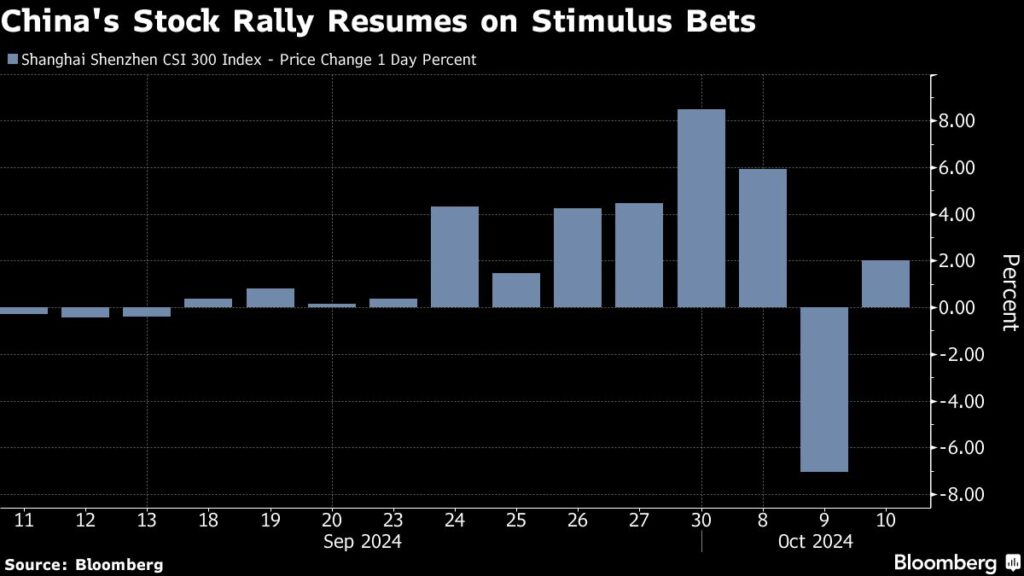

The CSI 300 Index rose as much as 2.2% early Thursday, following a 7.1% plunge in the prior session in its worst day since 2020. An index of Chinese stocks listed in Hong Kong gained more than 3%.

Traders are pinning their hopes on the finance ministry’s briefing for the rally to sustain momentum. Fiscal measures have been missing from Beijing’s stimulus package so far, and money managers and strategists have warned that the rebound may be another false dawn if pledges aren’t backed up with real money.

Finance Minister Lan Fo’an is expected to introduce moves to strengthen fiscal policy to shore up growth, and answer questions from reporters on Saturday, according to the State Council Information Office.

Chinese stocks started rallying from late September after Beijing unveiled a barrage of monetary stimulus and vowed to boost fiscal spending. The onshore benchmark surged more than 30% from a September low through Tuesday, before sliding Wednesday on profit taking and emerging skepticism.

How long the momentum can last will hinge on the scale and speed of follow-up policy action, with lackluster holiday spending data a reminder that the economy is far from gaining a solid foothold. Any disappointment from the Saturday briefing may renew a selloff.

The ministry “will likely discuss a supplementary fiscal package for the remainder of the year, although it may be modest in size,” Morgan Stanley economists led by Robin Xing wrote in a note.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here