Just weeks out from Election Day, Trump Media & Technology Group is on a winning streak.

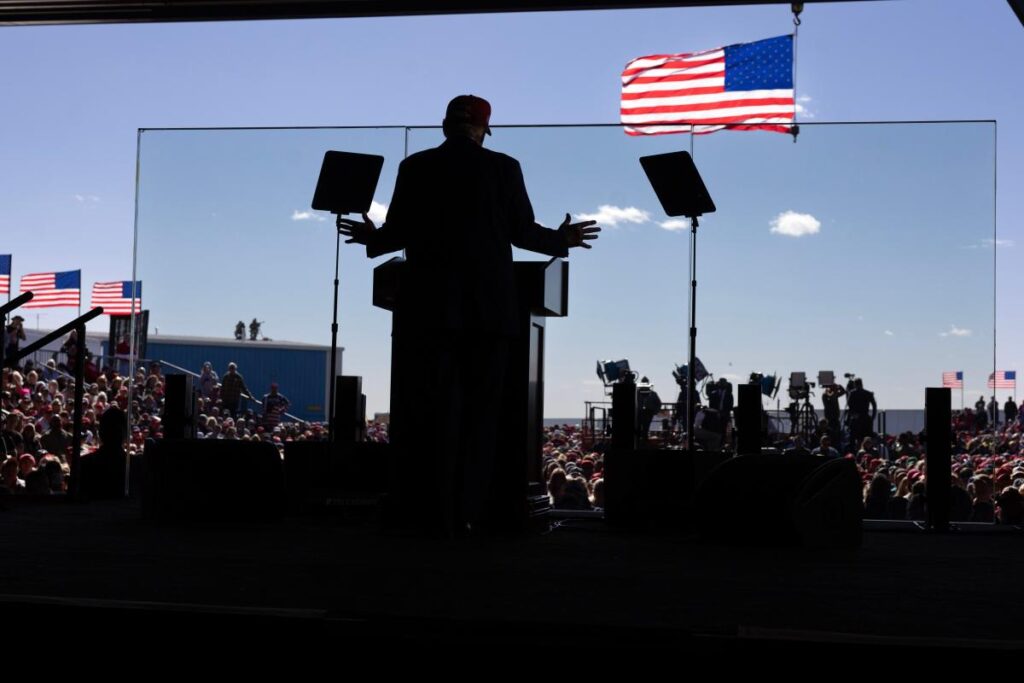

Shares surged Monday after a surprise appearance by Tesla CEO Elon Musk at Donald Trump’s return to Butler, Pennsylvania, where he survived a July 13 assassination attempt.

Tuesday saw another rally as investors sized up Democratic nominee Kamala Harris’ performance in a recent flurry of media appearances. Shares jumped nearly 19% to $21.80.

While the presidential race is shaping up to be a nail-biter, “the perception is that he is now winning,” Tuttle Capital Management CEO Matthew Tuttle said of Trump.

The publicly traded social media company whose majority shareholder could be the next president of the United States is an investment some are eager to wager on. The flagship product Truth Social is the GOP presidential nominee’s bullhorn of choice, so it would be required reading during a Trump administration.

That explains why Trump Media shares are on a four-day tear, erasing some recent losses. But the stock’s wild swings are a reminder of how risky placing bets on Trump Media can be, Tuttle said. Shares have lost more than 60% of their value since the company’s public debut.

“It’s a huge gamble for long-term investors,” he said.

Trump Media’s fate, like Trump’s, will be decided at the ballot box, according to Tuttle.

In regulatory filings, Trump Media has telegraphed how critical Trump is to the company’s brand, warning that its value “may diminish” if Trump’s popularity falters.

What’s more, Trump Media does not trade on its business fundamentals. It’s losing money and has nearly no revenue. In August, it disclosed a net loss of $16.4 million on revenue of just under $837,000, a year-over-year decline of 30%.

The company has also been dogged by litigation and reports of management turmoil. The company disclosed in a regulatory filing Thursday that its chief operating officer, Andrew Northwall, resigned last month and that it would release nearly 800,000 shares to an early investor because of a court order.

“If he wins, they could do something with this company,” Tuttle said of Trump. “If he loses I don’t see any way it stays afloat.”

Trump Media shares have been under pressure since President Joe Biden dropped out of the presidential race.

Last month the stock plunged to its lowest level since it began trading as a public company after the six-month lock-up period for insiders including Trump to unload shares expired.

Trump has said he will not sell his 60% stake in Trump Media, worth about $1.6 billion. At Trump Media’s height, his stake was worth nearly three times that.

This article originally appeared on USA TODAY: Trump Media is on a winning streak. Should you invest in DJT?

Read the full article here