(Bloomberg) — Chinese developers’ shares plunged after an unprecedented rally, fueling a broader market retreat as investors reassessed the sector’s risks.

Most Read from Bloomberg

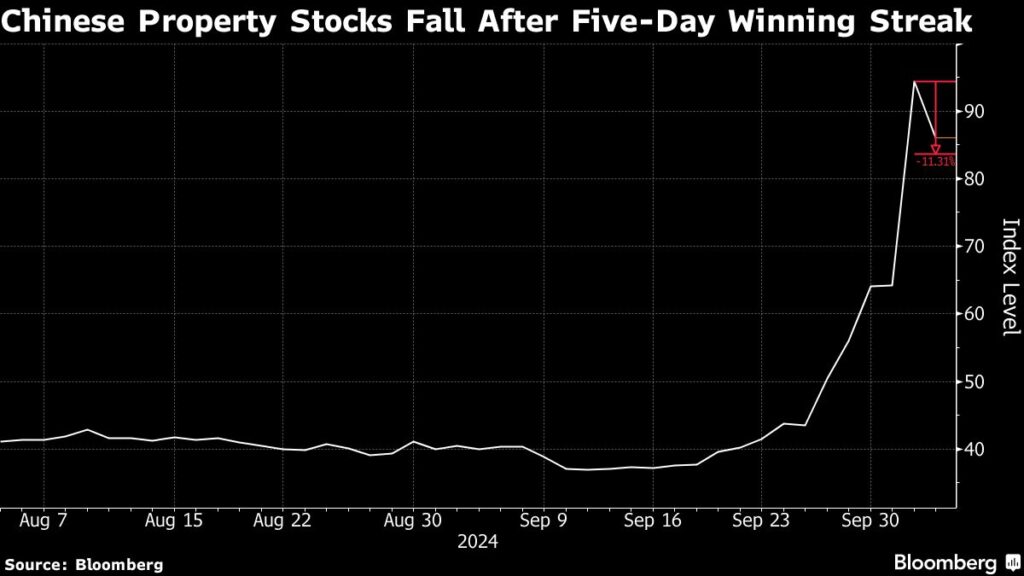

A Bloomberg Intelligence gauge of Chinese property firms fell as much as 16% Thursday, ending a five-session winning streak that included Wednesday’s whopping 47% surge. Shimao Group Holdings Ltd. and Sunac China Holdings Ltd. were among the top losers.

The developers’ slump comes as an epic rally in Chinese stocks stalled, with profit taking setting in following gains of more than 30% from a September low. Further darkening the mood toward the sector was a warning by JPMorgan Chase & Co. of high risks in further chasing a sentiment-driven rally given demanding valuations.

While authorities looked eager to support the industry, the policy easing details announced over the past one to two weeks showed “the magnitude is actually not as strong as what some investors might have expected,” JPMorgan analysts led by Karl Chan wrote in a note dated Wednesday. “If data or policy support turns out to be weaker than expected, the correction magnitude might also be drastic.”

Investor mood toward the world’s No. 2 economy has turned notably brighter since last week when Beijing unveiled fresh stimulus measures that included interest-rate cuts, freeing-up of cash for banks and liquidity support for stocks. Four major cities also eased home-buying curbs and the central bank moved to lower mortgage rates.

The intensified efforts to rescue the housing market came after the country’s slump in home sales deepened in September.

Most investors expect China’s developer stock rally to be over around mid- to the end of October, JPMorgan’s analysts wrote, adding that it is hard to gauge the potential upside from a valuation perspective in a sentiment-driven rally.

Instead, the Wall Street bank recommends property management stocks including China Resources Mixc Lifestyle Services Ltd. and Poly Property Services Co., citing solid fundamentals and still “comfortable” valuations.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here