Emini S&P December made a low for the day just 3 points below the buying opportunity at 5745/35 & immediately shot higher to both targets of 5755, 5765.

The low & high for the last session were 5733 – 5822.

Emini Nasdaq December broke lower but made a low for the day at strong support at 19900/800

Last session high & low for the last session were: 19818 – 20331.

Emini Dow Jones December trades mostly sideways for many days.

Last session high & low for the last session were: 42251 – 42656.

Emini S&P September futures

Emini S&P longs at strong support at 5745/35 worked perfectly as we held above 5730 & shot higher to targets of 5755 & 5765 then as far as 5783.

If we continue higher look for a retest of the all time high of 5820/30.

So we have support again at 5745/35 & longs need stops below 5730.

A break lower this week however could target 5695/90 & even support at 5680/70.

Longs here need stops below 5660.

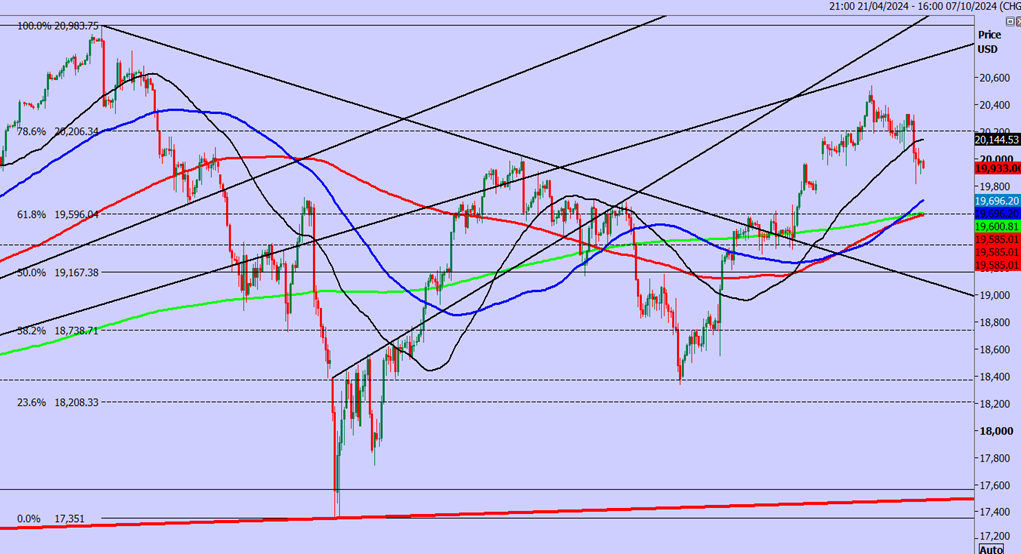

Nasdaq September futures

We broke support at 20250/150 to hit my next downside target & very strong support at 19900/800 with a low for the day exactly here.

We then shot higher to 20081.

If we continue higher look for 20150/200, perhaps as far as 20250/290.

Strong support again at 19900/800 – Longs need stops below 19700.

A break lower today however risks a slide to 19550, perhaps as far as strong support at 19400/300.

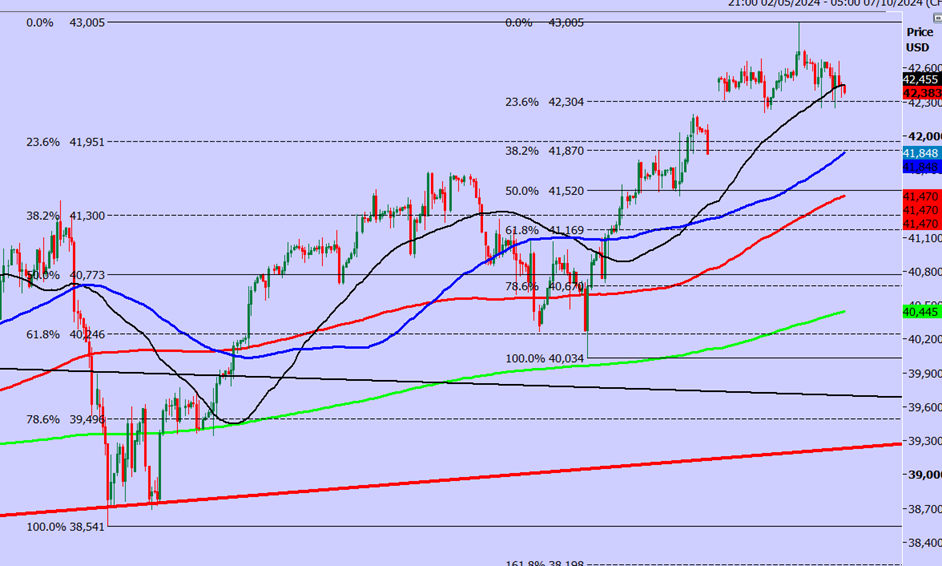

Emini Dow Jones September futures

We wrote: I think gains are likely to be limited in severely overbought conditions but there is definitely no sell signal & I will remain a buyer on any profit taking.

We did dip as far as support at 42350/250 as predicted & this did prove to be an excellent buying opportunity again but longs need stops below 42150 on a retest today.

Targets of 42500 & 42650 were hit immediately, meaning we caught the low & high for the day for the second day in a row.

A break lower this week however risks a slide to 42000/41900 & longs need stops below 41800.

Read the full article here