(Bloomberg) — Prime Minister Michel Barnier’s first policy address on Tuesday bought his new government some much-needed time to fix France’s finances, while avoiding a major rebuke from investors.

Most Read from Bloomberg

In a speech to lawmakers in Paris, the new premier said he would delay by two years the target date to bring the budget deficit within 3% of economic output until 2029. He outlined plans for a combination of spending cuts and tax hikes on the wealthy and large companies

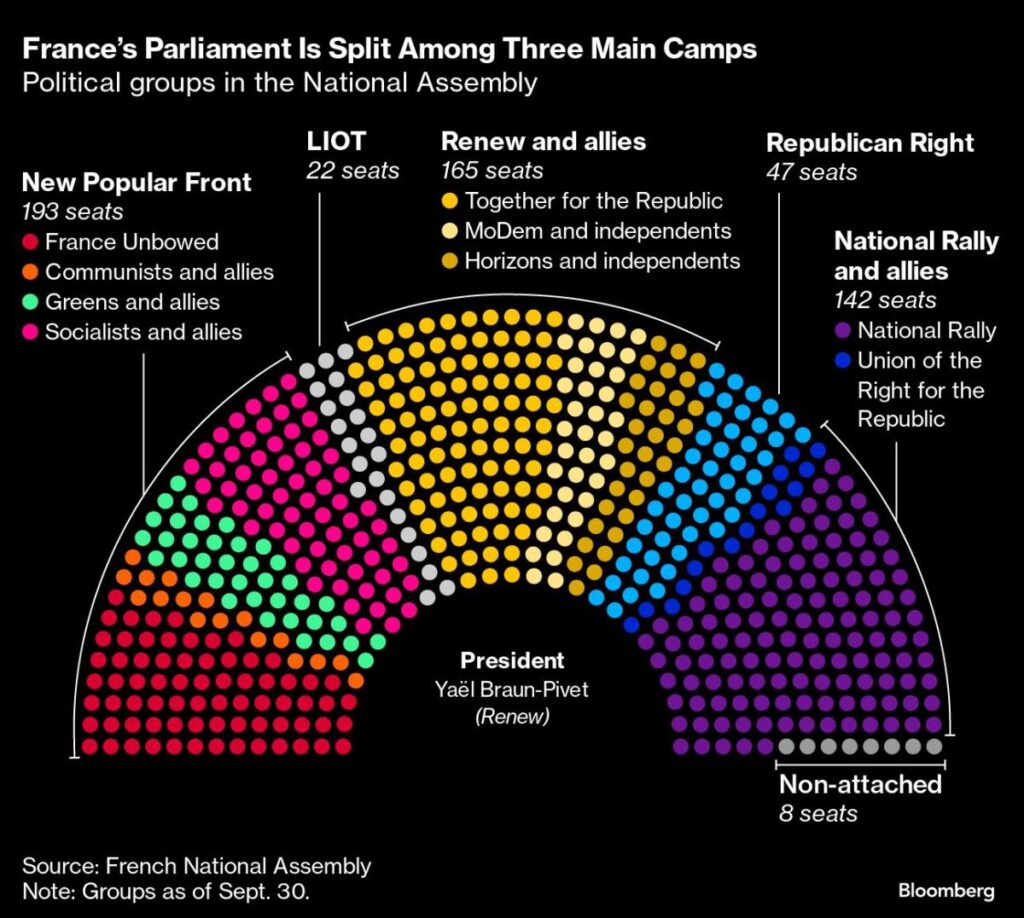

Repairing France’s public finances is a core challenge for Barnier, whose premiership is tenuous given his centrist coalition doesn’t have the numbers to ward off a concerted opposition attempt to topple the government. Investors have been dumping French assets in recent months, with the risk premium on the country’s debt approaching its highest level since the euro-area crisis.

“The real sword of Damocles is our colossal financial debt,” said Barnier, who was appointed by President Emmanuel Macron Sept. 5. “If we are not careful it will put our country on the edge of a precipice.”

French bond yields remained substantially lower on the day amid a broad market rally, despite trimming gains slightly after Barnier spoke. The 10-year yield spread over Germany — a gauge of French bond risk — tightened one basis point to 78 basis points, compared to a peak of 82 basis points in recent days.

Barnier said the deficit is set to expand beyond 6% this year and the situation would worsen further without action. The European Union has already put France in a special procedure designed to enforce stricter fiscal discipline in countries deemed to have excessive debt and deficits.

As a first step, Barnier said his government would aim to reduce the deficit to 5% of economic output next year with two-thirds of the effort coming from spending cuts and the rest from tax increases on wealthy individuals and big companies with “significant profits.”

The government already warned last week that the deficit this year would be much wider than the 4.4% the previous administration initially planned, as tax receipts have disappointed and local authorities have ramped up spending. The slippage has rattled investors, who already started selling French assets when Macron dissolved parliament in early June.

Barnier did appear to receive some political breathing room when the leader of the far-right National Rally, Marine Le Pen, indicated she wouldn’t immediately support a no-confidence motion the left is expected to propose in the coming days.

If the National Rally were to join such a motion, the measure could easily gain the numbers to pass, which would force the government out of office.

Responding to Barnier at the National Assembly, Le Pen said her party would refrain from bringing down the government and urged the administration to transform the prime minister’s stated intentions into action. She also thanked Barnier for his “courtesy” in respecting her party like others.

The nationalist group “doesn’t plan to drag the country into chaos,” Le Pen said. “The National Rally has made a responsible choice of refusing to censure your government from the outset to give it a chance – as infinitesimal as it may be – to finally implement the necessary measures for repair.”

Increasing taxes risks fueling tensions among lawmakers backing his government who are reluctant to reverse Macron’s mantra of boosting business and the economy by not raising taxes.

Barnier’s support in parliament was already narrow, based on an awkward alliance between Macron’s centrist bloc and lawmakers from his own conservative Republicans party who hold fewer than 50 out of 577 seats.

He said higher taxes would be time-limited and targeted so as not to undermine France’s economic competitiveness.

“Confronted with our immense challenges we don’t have the choice: Our responsibility is to lessen the burden and get back room to maneuver with the budget,” Barnier said.

Barnier’s predecessor, Gabriel Attal, said Macron’s lawmakers are prepared to consider approving some measures, such as taxing share buybacks. But he cautioned that even if tax increases are limited to large companies that could still weaken them and their suppliers and increase unemployment.

Barnier said savings would also come from tackling inefficiencies and fraud on tax and social security.

The government “won’t work miracles,” Barnier said. But it’s “ready to overcome the obstacles one by one and strive to answer the French people’s concerns.”

–With assistance from James Hirai.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here