Artificial Intelligence (AI) prodigy Nvidia (NVDA), the world’s third-highest-valued stock, experienced a material decline in market capitalization following its Q2 earnings in late August. However, NVDA stock has shown some vigor again, rising 5% in the last week. After temporarily surpassing the $3 trillion milestone earlier this year, investors are wondering what the future will hold. My thesis remains unchanged — I’m bullish on NVDA shares as an investment due to its clear AI supremacy and exponential growth potential.

NVDA’s Long-Term AI-Driven Growth Trajectory Remains Intact

It is well known that NVDA is positioned for a long runway of growth with top-notch clients like Microsoft (MSFT), Alphabet (GOOGL), Meta (META), and Amazon (AMZN) bulking up on their AI efforts. However, beyond these leading customers, Nvidia’s AI penetration is still rising across all industries, increasing my optimism for NVDA stock. Enterprises across industries and geographies are eager to incorporate AI benefits into their operations. Likewise, NVDA continues to enter into collaborations with top businesses.

There’s a reason enterprises are flocking to NVDA for their AI ambitions. Beyond being the leader in AI GPU processors, NVDA provides a complete end-to-end AI infrastructure that supercharges productivity. That’s something that few, if any, of its global AI peers can deliver.

NVDA Remains a One-Stop AI Powerhouse with Margin Growth

Another reason for my optimism about NVDA is CEO Jensen Huang‘s relentless focus. He is committed to transforming NVDA into a fully AI-driven data center powerhouse that covers all aspects of hardware and software under the NVDA brand.

This strategy is a key reason why NVDA can maintain premium pricing for its products, contributing to steady growth in its profit margins. However, critics argue that NVDA’s exceptional revenue and margin growth may not be sustainable. Some members of the investment community are worried about a slowdown in revenue growth over the coming years.

For context, NVDA reported an extraordinary 217% increase in its data center revenues for fiscal 2024. While that growth is expected to moderate to around 130% in 2025, this remains an impressive triple-digit figure, especially considering the strong FY2024 baseline for comparison. Although lower than today’s pace, these are still remarkable growth projections for the future. I view bullish analyst estimates as a reason to remain confident in this AI leader, particularly as the disruptive potential of generative AI is only beginning to unfold.

Demand for NVDA’s chips is robust and will boost future revenues in the coming quarters. Therefore, despite some investor concerns, I expect NVDA will continue to maintain its clear AI dominance with an unbeatable competitive moat and best-in-class AI products and services.

A Discussion of Nvidia’s Impressive Quarterly Earnings

Nvidia posted yet another stellar Q2 result on August 28, 2024, driven by accelerated computing and the continued momentum of generative AI. Adjusted earnings of $0.68 per share handily beat the consensus analyst estimate of $0.65 per share. The figure came in much higher (+152%) than the Fiscal Q2-2023 figure of $0.27 per share.

The company posted a 122% year-over-year revenue growth, delivering $30.04 billion for the three months ending July 31 and surpassing analysts’ projections. Importantly, Data Center revenues, the company’s crown-jewel division, grew 154% year-over-year to $26.3 billion. Additionally NVDA’s adjusted gross margin expanded 5 percentage points to 75.1% from 70.1% a year ago. Many investors were apparently hoping for even bigger numbers, and therefore the stock dropped slightly following the Q2 report. Shares then continued a downtrend until they bottomed out on September 6, just above the $100 level.

Nvidia’s guidance for the 3rd quarter appeared less promising to investors, with revenues expected to reach about $32.5 billion. Guidance came in below expectations. Adjusted gross margins are forecast to level off at about 75%, versus 75.15% delivered in Q2.

NVDA’s Insider Selling Concerns are Over

Insider selling at Nvidia added downward pressure on NVDA shares in recent months. CEO Jensen Huang sold NVDA shares across multiple transactions from June to September, but it’s important to know that those sales were part of a predetermined trading plan adopted in March. This plan allowed Huang to sell up to six million NVDA shares by the end of Q1 2025.

Notably, Huang has completed sales of more than $700 million worth of NVDA stock. Despite the significance of these sales, he remains the largest individual shareholder of the company. At last report, Huang held 786 million shares through various trusts and partnerships, and 75.3 million shares directly, according to company filings. Combined, Huang controls a ~3.5% stake in the company, with an approximate total of 859 million shares.

NVDA Valuation Isn’t Expensive, Given Its Earnings Growth Prowess

Investors may have been hesitant to buy NVDA stock at current levels, pointing to the stock’s extraordinary run as well as due to concerns about the company’s and slowing growth.

On the contrary, however, my contention is that NVDA stock is not as expensive as it may seem. Currently, it’s trading at a forward P/E ratio of about 43x (based on FY2025 earnings expectations). This is actually cheaper than some valuation multiples of its peers. For instance, NVDA’s closest competitor and U.S.-based semiconductor company, Advanced Micro Devices, carries a 46.8x forward P/E. Interestingly, NVDA’s current valuation still reflects a 10% discount to its five-year average forward P/E of 47.3x.

Given NVDA’s consistent outperformance and strong growth potential, the current valuation appears reasonable and justified. Any future dip in the stock price could represent a solid buying opportunity, in my opinion, especially considering Nvidia’s immense potential in the rapidly expanding AI market.

Is NVDA Stock a Buy or Sell, According to Analysts?

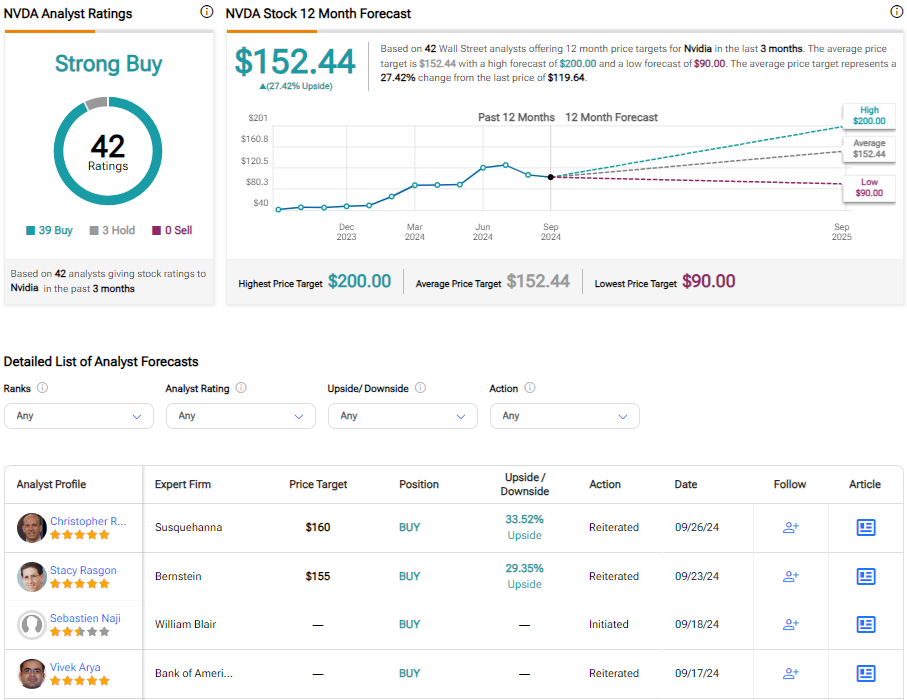

With 39 Buys and three Hold ratings from analysts in the last three months, the consensus TipRanks rating is a Strong Buy. The average Nvidia stock target price of $152.44 implies potential upside of about 26% for the next year.

Conclusion: Consider NVDA Stock for Its Long-Term AI Potential

Despite recent weakness, NVDA shares have nearly tripled over the past year compared to a rise of about 37% for the Nasdaq 100. The post-earnings sell-off for NVDA stock, in my view, was largely driven by profit-taking. After bottoming near $100, the stock appears to be in recovery mode now.

In the near term, I believe ongoing economic and political uncertainties may keep the stock range-bound. However, I view any dips as buying opportunities. I see NVDA as a strong long-term investment given the significant continued potential of AI.

Read full Disclosure

Read the full article here