(Bloomberg) — Tightening spreads on bonds issued for US banks is signaling that credit investors see less risk there, a perception equity investors should heed, says Wells Fargo & Co. analyst Mike Mayo.

Most Read from Bloomberg

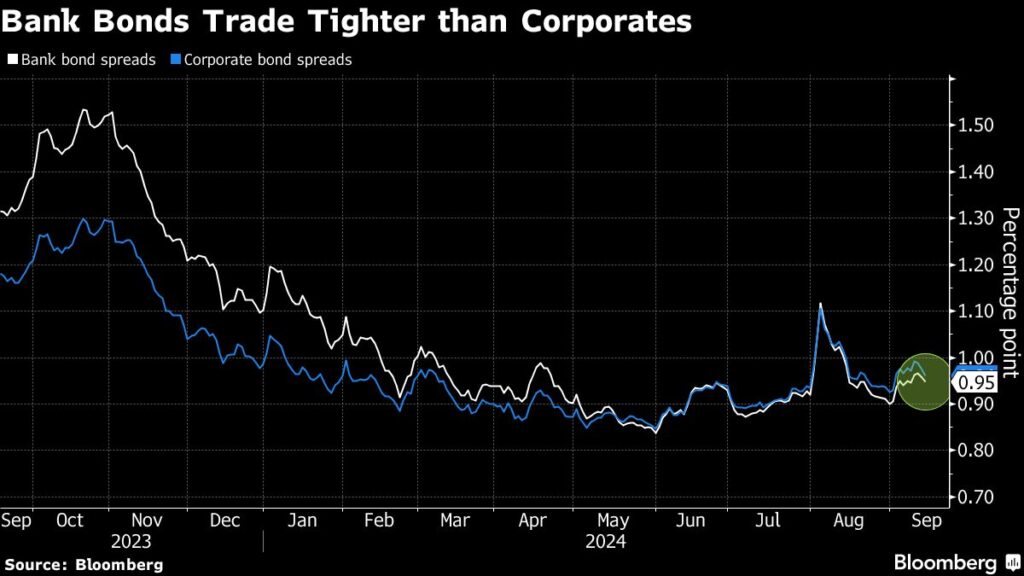

Spreads on an investment-grade bank bond are currently around 95 basis points, one basis point tighter than a corporate bond spread. They’ve fallen more than 30 basis points from the same time last year, trading better than corporate bonds since May.

“The $7 trillion investment-grade bond market now says banks are less risky than corporates, shrugging off the recent brouhaha in bank stocks from recession and rate concerns,” Mayo said in the note late Friday.

After rallying through the summer, bank stocks have been volatile amid uncertainty over the Federal Reserve’s path for rate cuts and the economy.

Shares of US banks have rallied in recent months, amid rising optimism for the economy, softening regulatory proposals and an approaching interest rate cut. The KBW Bank Index soared nearly 10% in July for its best month of 2024, pushing the sector to its highest level in two years.

Then presentations at an industry conference last week soured the mood, with JPMorgan Chase & Co. warning analysts’ estimates are too high for next year.

Mayo’s base case is for the Federal Reserve to start cutting interest rates and for the economy to avoid a recession, noting that “when rate cutting cycles did not involve a recession, banks outperformed each time.”

A sharp rise in loan delinquencies that historically preceded a recession hasn’t materialized, according to Mayo, and lower rates coupled with no recession would be good for banks.

“The bond market is rewarding banks for improved resiliency when the equity market is not,” he wrote.

In a separate note over the weekend, Bank of America Global Research analysts led by Ebrahim Poonawala wrote that the stocks could be volatile given the macro uncertainty on the pace of interest rate cuts, economic landing and election.

“If the end result is an improving growth backdrop for 2025, structurally higher interest rates with a positively sloping yield curve and manageable policy risk out of DC, then we want to be long bank stocks,” Poonawala writes.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here