NurPhoto/Getty Images

The bank said that delivery times for pre-orders of the new iPhone 16s are shorter than those observed for last year’s iPhone 15 launch, suggesting a balance in supplies that hasn’t been tested by a surge in demand.

“Notably, compared to the first day of iPhone 15 pre-orders, delivery times for the iPhone 16 are, on average, a week shorter,” Citi analysts wrote.

Related: Huawei answers Apple’s iPhone 16 with the first trifold phone

“Delivery times are longest for the Pro Max models, followed by the Pro, and consumers are opting for larger storage options, with 256GB and 512GB models showing longer lead times,” Citi added, calling this tilt towards higher-end models a “premiumization” trend.

Hilarious that we are watching Apple’s stock go down billions because of one report that sales were light for the new phone. We have heard this story before…

— Jim Cramer (@jimcramer) September 16, 2024

Analysts from Jefferies also said it observed soft consumer interest, particularly in the United States, and noted that some iPhone 16 models have been available for store pick-up almost immediately.

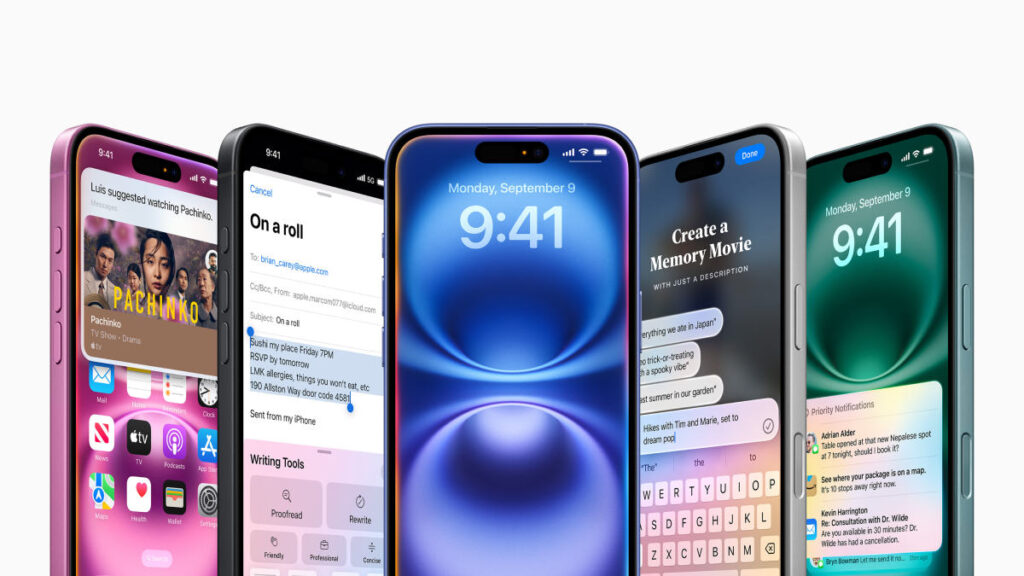

iPhone 16 demand dip

Taiwan-based Apple analyst Ming-Chi Kuo, meanwhile, reported that Apple sold an estimated 37 million new iPhone 16 units in its opening weekend, down around 12.7% from the first days after last year’s iPhone 15 launch.

Demand for the new iPhone series could prove crucial for the broader AI investment thesis, as Apple is seen as the best-placed tech group to to deliver the new technology at the consumer-facing level through its 1.4 billion user base.

Related: Analyst revisits Apple stock price target after iPhone 16 launch

It’s also looking to infuse interest in the iPhone, which accounts for around half its annual revenue, following a long stretch of weakening sales.

More AI Stocks:

For the three months ending in June, iPhone revenue slipped 1% from a year earlier to $39.3 billion, while China sales were down 6.5% to $14.73 billion.

Apple shares were marked 2.6% lower in premarket trading to indicate an opening bell price of $217.70 each, a move that would extend the stock’s one-month decline to around 3.6%.

Related: Veteran fund manager sees world of pain coming for stocks

Read the full article here