A cryptocurrency analyst who accurately called the Bitcoin correction earlier this year now believes BTC could turn bullish over the coming weeks.

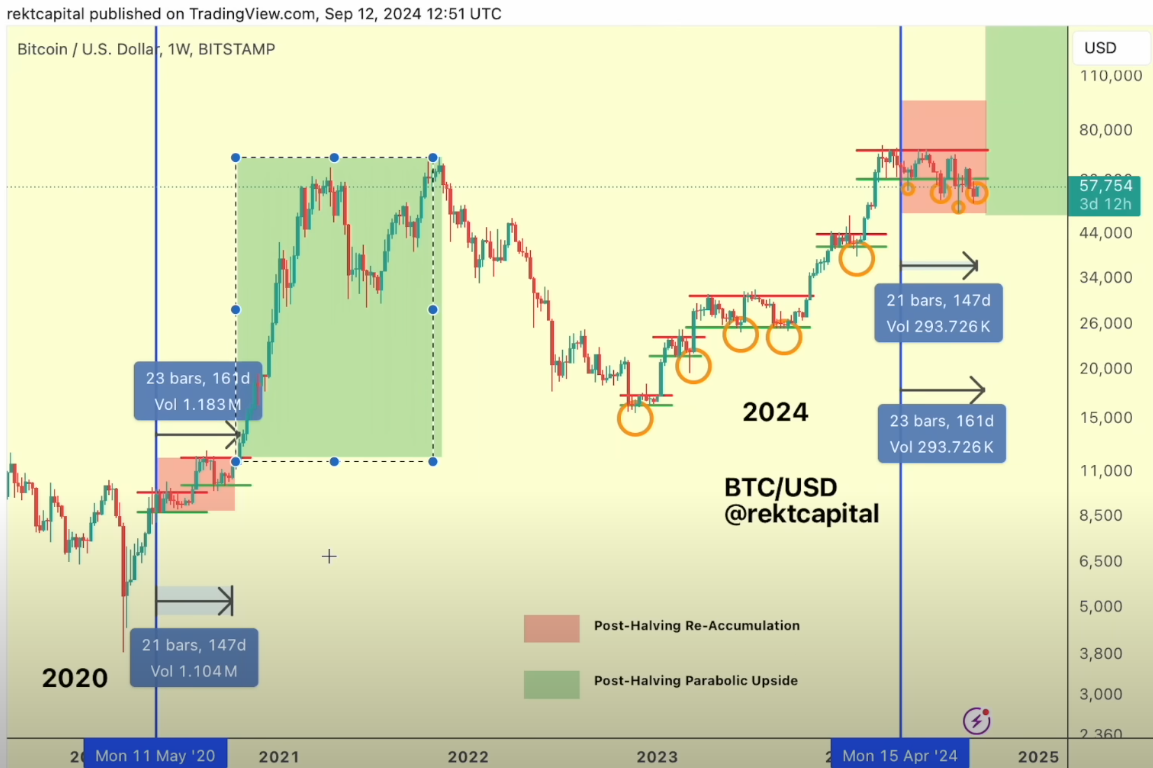

Pseudonymous crypto strategist Rekt Capital tells his 87,600 YouTube subscribers that Bitcoin looks primed for October rallies based on the flagship crypto asset’s history during the halving years.

Earlier this year, Bitcoin witnessed another halving event, when BTC miner rewards were slashed in half.

Says Rekt Capital,

“So we’re not really going to see that sort of downside in this upcoming October. In fact, we’re probably going to see upside in October. We just simply tend to see a strong October across time… It all just comes down to the fact that we’re going to have a strong October.”

On the potential gains Bitcoin could make next month, the pseudonymous analyst says,

“I expect us to have a double-digit upside month… We tend to see double-digit upside in halving years – 14% and 27%, respectively, in 2016 and 2020. So 14% would get us to $67,500…

But if we were to look at 2020 returns for October, 27.5%, then that would actually get us to new all-time highs….

So 27%, 14%, 10% those are on the lower end in terms of returns for the month of October.”

Rekt Capital also says that Bitcoin could be weeks away from starting a more significant bullish phase of the cycle.

“And if we look at history, history suggests to us that we tend to break out from this re-accumulation range [roughly between $55,000 and $73,000.] 160 days after the halving. And so that gets us into very, very late September, early, early October…

We may very well be on the cusp of that parabolic phase, if history indeed repeats.”

Bitcoin is trading at $60,592 at time of writing, up 4.49% in the past day.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Generated Image: Midjourney

Read the full article here