Whales have started accumulating Dogecoin as bullish on-chain signals surfaced for the largest meme coin.

According to data provided by IntoTheBlock, the Dogecoin (DOGE) large holders’ inflow increased by 970% on Sept. 11 — rising from 46.25 million to 493.15 million DOGE. The token’s whale outflow plunged from 442.12 million to 78.17 million DOGE.

Data shows that the large holders’ net inflow reached 414.97 million DOGE, worth $42.46 million, yesterday. The movement shows that whales have started accumulating Dogecoin and the selloff has cooled down.

Notably, Dogecoin is mostly dominated by large holders with 62% of its supply sitting in whale addresses. The amount of transactions consisting of at least $100,000 worth of DOGE reached $942 million over the past week.

Per ITB data, the asset’s exchange net inflow also declined from 84.83 million to 33.42 million DOGE on the same day. Decreasing exchange inflow usually leads to lower selling pressure.

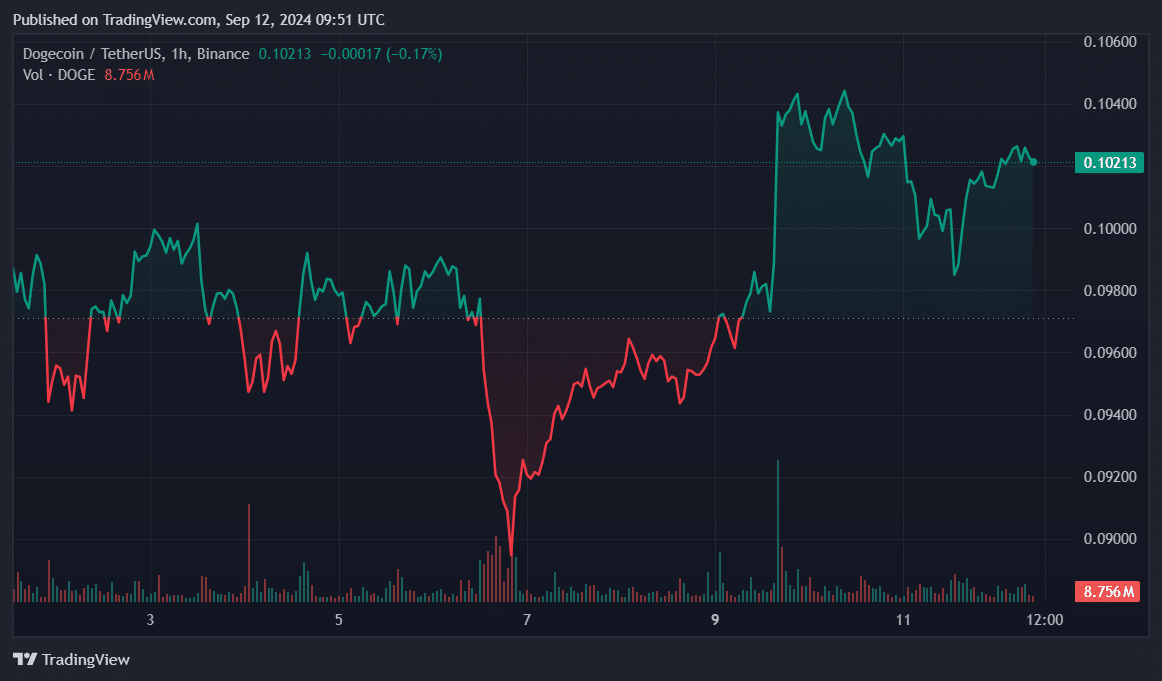

DOGE is up 1.6% in the past 24 hours and is trading at $0.1024 at the time of writing. The meme coin’s market cap is hovering at $14.9 billion, making it the eighth-largest digital currency.

At this point, DOGE is down by 86% from its all-time high of $0.73 in May 2021.

On Aug. 31, Elon Musk, Tesla’s billion CEO, showed interest in bringing the meme coin back to the automotive company as a form of payment. Musk’s claim came a few days after a U.S. court decided to dismiss the $258 billion lawsuit against the billionaire and his companies.

Read the full article here