The founders of analytics firm Glassnode say that a bearish monthly candle for Bitcoin in September is less likely than most market participants believe.

Jan Happel and Yann Allemann, who go by the handle Negentropic, tell their 63,000 followers on the social media platform X that they doubt 2024 will print another red September.

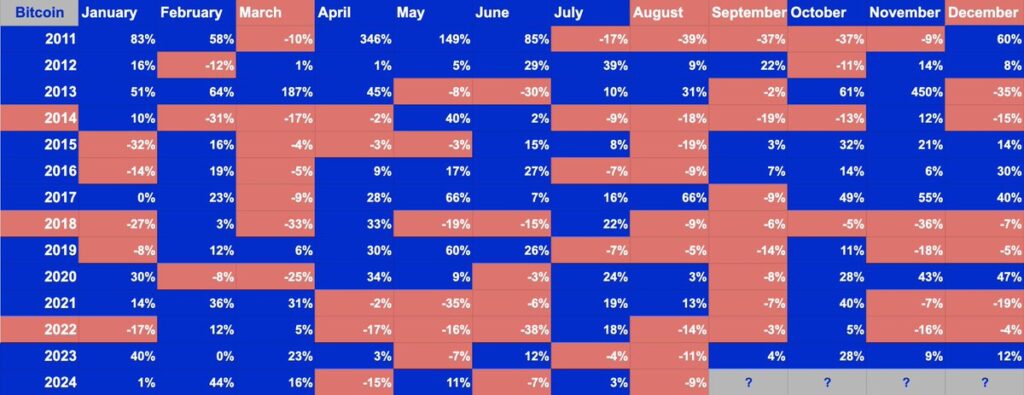

“September is historically bearish for Bitcoin with many calling it ‘The Curse of September.’

We doubt 2024 will add to this narrative:

– The month is starting on a low note, with upward catalysts

– If everyone’s expecting it, it’s less likely to happen (Soros’ reflexivity)”

While BTC is down slightly to start the month, Negentropic notes that the flagship cryptocurrency is up when paired with the Nasdaq 100 index. The analysts say that they expect the outperformance to continue.

“Feeling bearish? Since September’s market open… Bitcoin has significantly outperformed the NASDAQ 100. See the BTC-QQQ performance below.

In the past this was a rare sight on down days, in the future we suspect it will be common.”

With crypto markets going through a mid-week sell-off, the analysts say that some outlier altcoins showing strength may be worth keeping an eye on in the near future. They note Starknet (STRK), Celestia (TIA) and Jupiter (JUP) as examples.

“When identifying altcoins to analyze, ‘red days’ are useful.

In the heatmap, boxes are sized by volume/market cap, and colored by today’s performance.

Altcoins bouncing back from the dip with strong volume (big, green boxes) might have fundamental strength.

STRK, TIA, JUP.”

At time of writing, Bitcoin is trading at $58,374, while the total crypto market cap (TOTAL) is just above the $2 trillion mark.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Featured Image: Shutterstock/INelson

Read the full article here