The popular S&P 500 (SNPINDEX: ^GSPC) had a pretty decent month in August 2024. The economic news was more good than bad last month, lifting the index by 126 points (or 2.3%).

But it wasn’t a smooth ride. 52 of the S&P 500’s 503 components gained more than 10% in August while 20% members saw price drops of 10% or more. Three of these household names took haircuts of 30% or more.

What happened to the three worst-performing S&P 500 stocks in August — and are they great buys or dangerous value traps right now?

Let’s find out.

Super Micro Computer: Down 37.6% in August

Server systems builder Super Micro Computer (NASDAQ: SMCI) took two deep dives in August.

First, the company reported mixed fourth-quarter results on August 6. The company also announced a 10-for-1 stop split that evening, but that move didn’t distract investors from the mottled earnings report. Instead, they focused on Supermicro’s weak profit margins and the stock closed 20.1% lower the next day.

A single-day price drop of 19% followed in the last week of August. A short-seller firm published a scathing report on the company, made worse by the fact that Supermicro delayed the filing of its annual report on the same day.

Short-sellers often make splashy headlines with their accusations, but their track record for accuracy is not impressive. That being said, the late filing of annual financials and weaker profit margins add up to a dark picture for many investors. In particular, Supermicro bears worry about the company’s pricing strategy as the in-demand artificial intelligence (AI) servers are selling at lower margins than other systems.

As it stands, Supermicro’s stock looks like a lower-priced version of head-to-head rival Dell. Management says that Supermicro’s margins should rebound in 2025, as the current pressure sprung from a rapid expansion of the company’s manufacturing facilities and a costly acceleration of its advanced liquid cooling technology.

The stock could be worth the risk if you’re willing to bet on Supermicro’s pricing power in the long run. Otherwise, Dell’s stock is a more stable way to address the same AI systems space at a reasonable valuation. Check your risk tolerance and invest accordingly.

Moderna: Down 35.1% in August

Vaccine innovator Moderna (NASDAQ: MRNA) took just on significant dive last month, but it was a steep one.

The company reported second-quarter results on August 1m crushing Wall Street’s average revenue target but falling short of the consensus bottom-line projection. More important, management lowered their full-year product sales outlook from roughly $4 billion to approximately $1.3 billion.

The weak revenue outlook resulted from soft sales in Europe and tighter competition in the American market for respiratory vaccines.

Should you take a second look at Moderna while the stock is down?

Well, the company faces the painful combo of rising competition and lower margins for its coronavirus vaccine. On the upside, it could overcome that difficulty with a broad portfolio of treatments for other diseases, including respiratory viruses and my own multiple sclerosis millstone. The company is putting its COVID-19 windfall to work, hoping to build a robust business for the long haul.

At the same time, regulatory approvals are hard to come by in the risky biotech industry and Moderna still stands in the shadow of much larger sector rivals. Moderna’s share price is now down 54.6% from May’s 52-week highs, but I’m still happy to stay on the sidelines. Noted growth investor Cathie Wood is buying the stock but there are too many variables in play for my taste.

Dollar General: Down 31.1% in August

Discount store operator Dollar General (NYSE: DG) might look like a safe bet in this era of stinging inflation and tight family budgets. However, the company’s financials don’t support that hypothesis at the moment.

This stock nearly made it to the goal line unscathed, posting a 2.3% gain from the end of July to August 28. But Dollar General reported second-quarter results before the opening bell on the 29th, and it wasn’t good news.

The company fell short of analysts’ consensus earnings and revenue targets, management said that its customers feel “financial constraints” in this economy, and the full-year revenue guidance was lowered from roughly $39.7 billion to $39.1 billion. The stock price plunged 32.1% lower that day.

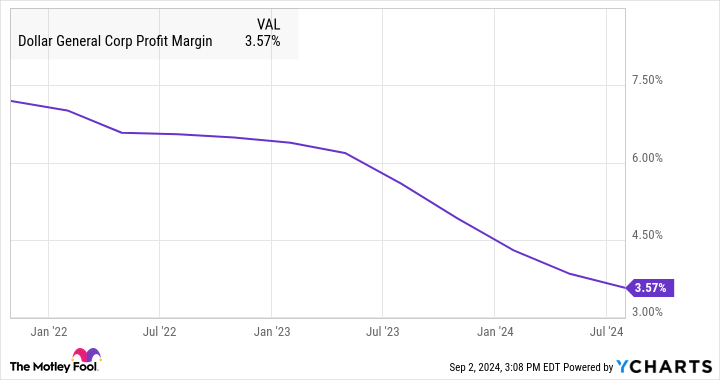

Dollar General hopes to turn the tide with an aggressive rebate program in the fall. That could boost top-line sales, but at the cost of an already skinny profit margin growing even slimmer:

Dollar General can’t afford to get in a race-to-the-bottom price war with other discount stores, but that’s the plan. This stock is trading at 7-year lows for good reason. It would take an impressive turnaround effort to fix what’s wrong with Dollar General. Deeper discounts don’t look like the right idea.

Should you invest in any of these struggling stocks?

There you have it. Among the three worst performers on the S&P 500 in August 2024, Supermicro could be a somewhat speculative value play. In my view, Dollar General and Moderna come with more risk than potential upside. All things considered, most investors should probably leave these struggling names alone right now. There are plenty of lower-risk fish in the sea, after all.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 3, 2024

Anders Bylund has no position in any of the stocks mentioned. The Motley Fool recommends Moderna. The Motley Fool has a disclosure policy.

Is It Time to Buy August’s Worst-Performing S&P 500 Stocks? was originally published by The Motley Fool

Read the full article here