-

Indexes rose on Thursday as investors focused on strong economic data.

-

US GDP grew at a slightly stronger pace in the second quarter than originally thought.

-

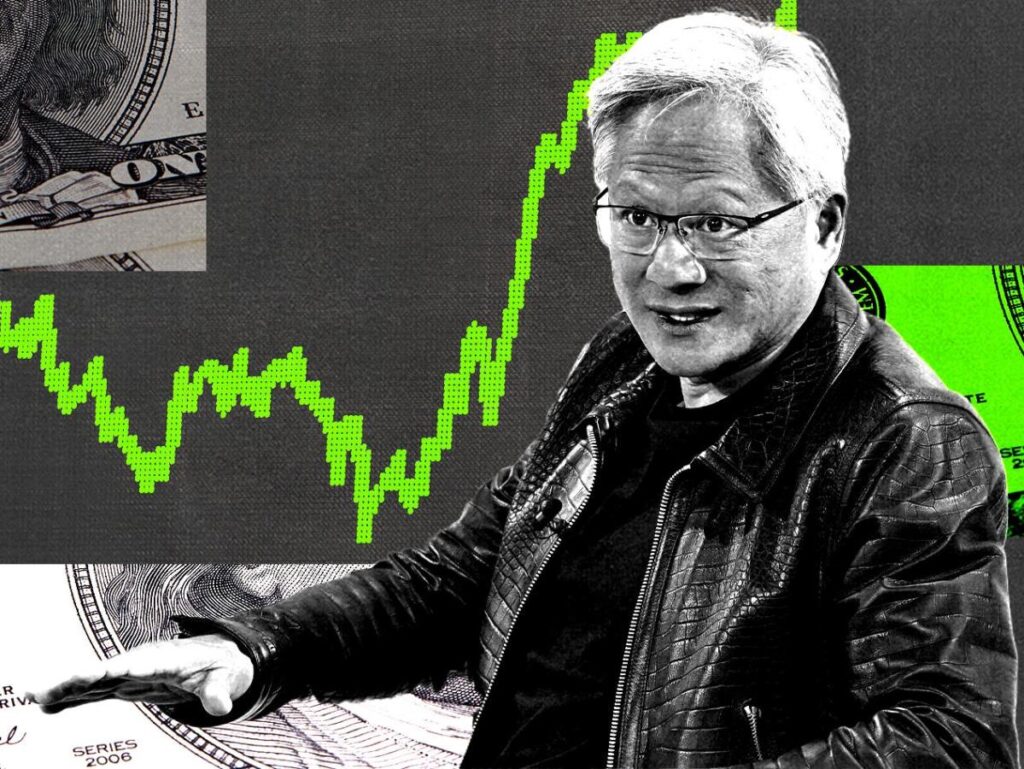

The gains came even amid a slide for Nvidia shares after the chipmaker’s earnings report.

Indexes rose Thursday as investors focused on encouraging economic data, which outweighed a post-earnings slump in Nvidia shares.

US GDP grew at a slightly stronger pace in the second quarter than originally thought, while jobless claims data was little changed from the previous week.

The positive economic signs blunted the impact of an earnings report from Nvidia that beat across the board, but was still viewed as a disappointment by investors carrying lofty expectations.

The chipmaker turned in the narrowest earnings beat Nvidia has seen in the past six quarters, and shares fell about 2% shortly after the market open.

As they’ve poured billions into AI, with a projected $1 trillion in AI investment in the coming years, investors have voiced concerns over how long it will take to see returns. Nvidia’s earnings showed challenges from increasingly complex products, which likely didn’t add much to investor confidence.

Here’s where US indexes stood shortly after the 9:30 a.m. opening bell on Thursday:

Here’s what else is going on today:

In commodities, bonds, and crypto:

-

Oil futures rose. WTI crude increased 1.53% to $75.62 a barrel. Brent crude, the international benchmark, rose 1.18% to $79.58 a barrel.

-

Gold was up 0.22% to $2,543 per ounce.

-

The 10-year Treasury yield fell two basis points to 3.863%.

-

Bitcoin rose 2.3% to $60,374.24.

Read the original article on Business Insider

Read the full article here