A crypto analyst and trader believes that Bitcoin (BTC) is currently transitioning into a bull market cycle phase.

The analyst pseudonymously known as Rekt Capital tells his 82,700 YouTube subscribers that based on the 2016 and 2020 market cycles Bitcoin is likely to soon reach new all-time highs (ATHs).

“We are definitely transitioning slowly but surely into the bull market stage. We’re probably already in this bull market phase, but we still have a lot more yet to come.”

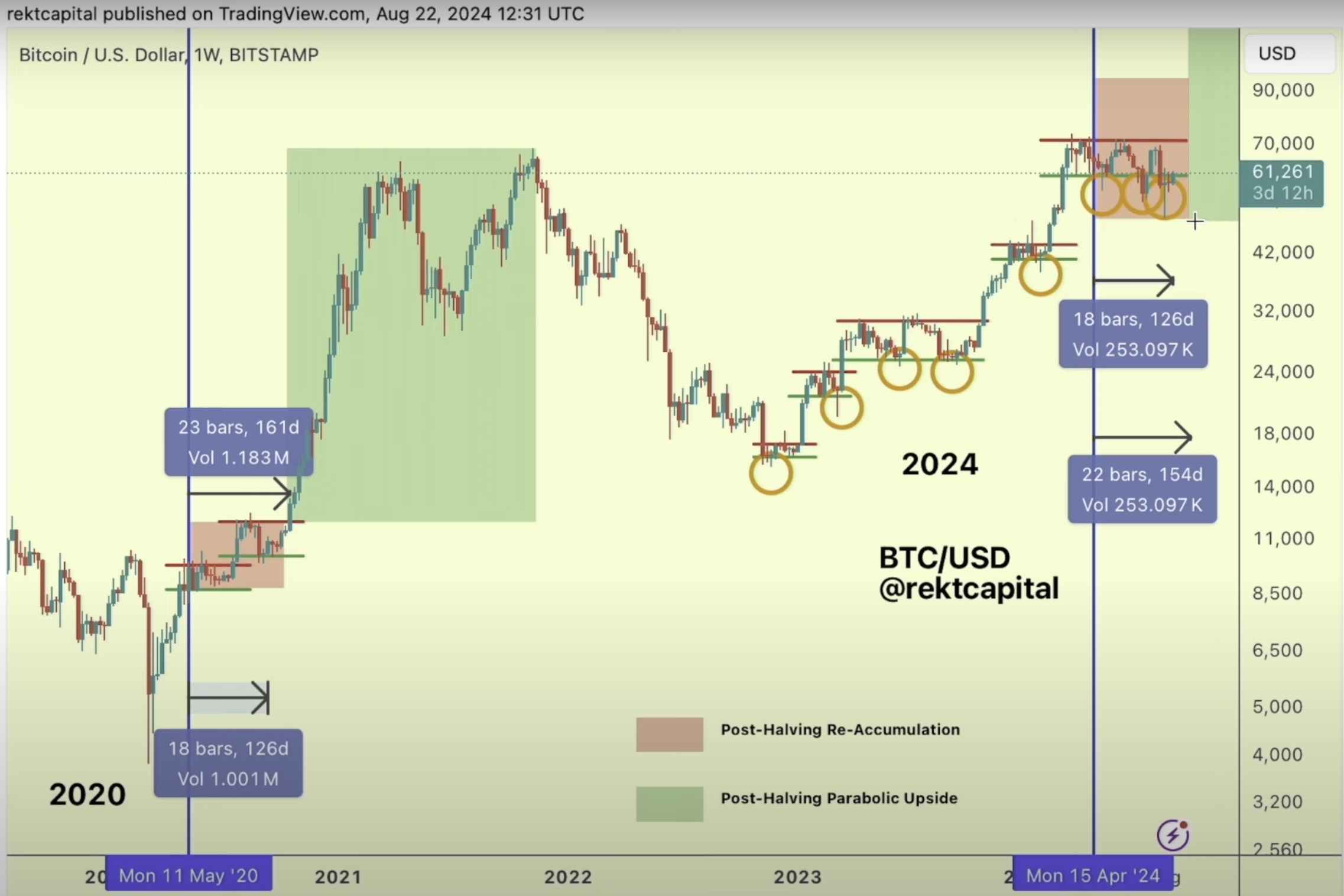

The analyst says that Bitcoin could break out of what he calls the post-halving re-accumulation phase of the market cycle as soon as next month, based on historic precedence, and then enter the most explosive phase of the market cycle.

“If we think about 2020, then we saw a breakout from the re-accumulation phase, which is this red box, and we saw a breakout into the parabolic phase 160 days after the [halving]. We’re currently 126 days after the halving, and so we still have over a month or so to go. So 160 days would see us break out in late September…

It took 150 days in 2016 to get us to that point. Whereas in 2020, it took 160 days. So anywhere from 150 to 160 days is where we should start to expect a historically recurring breakout from the re-accumulation phase after the halving to transition us into a post-halving parabolic upside phase.”

Bitcoin is trading for $60,413 at time of writing, up 1.5% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Generated Image: Midjourney

Read the full article here