In the past 24 hours, over $300 million has been liquidated in the crypto market, as Bitcoin (BTC) sharply crashed by around 5%. With that, the skyrocketing funding rate is now back to the ground.

The funding rate is a fee that helps keep the price of an asset’s perpetual future contract in equilibrium with its spot price. If the perpetual futures contracts are trading at a premium, the long traders will pay the funding fees to short traders, and vice versa.

Traders Anticipate Continued Uptrend After Bitcoin (BTC) Funding Rate Resets

The screenshot below shows that in the past seven days, long traders had to pay funding rates in the range of 0.21% to 0.38% for Bitcoin. These fees went as high as 0.89% for altcoins such as XRP.

Funding rates, apart from being just fees that help maintain the futures price near the spot price, also act as an indicator. High Bitcoin funding rates, in the positive direction, indicate that there is over-optimism in the futures market.

During such a scenario, there are increased chances of unexpected crashes, liquidating the long positions.

Read more: Where To Trade Bitcoin Futures: A Comprehensive Guide

Crypto market seven days funding rates. Source: Coinglass

On Tuesday, the open interest in the futures market stood at $33.67 billion. While in the options market, Bitcoin open interest hit a new all-time high, surpassing $17 billion.

Open interest indicates an interest in the derivatives (futures/options) market. A high open interest means that larger amounts of derivatives trades are active in the market.

What is Futures Trading? Source: YouTube

Read more: Best Crypto Derivative Exchanges in 2023

On Tuesday, Bitcoin fell by nearly 5% to $35,000, slightly cooling down the open interest while bringing the funding rates nearly back to neutral.

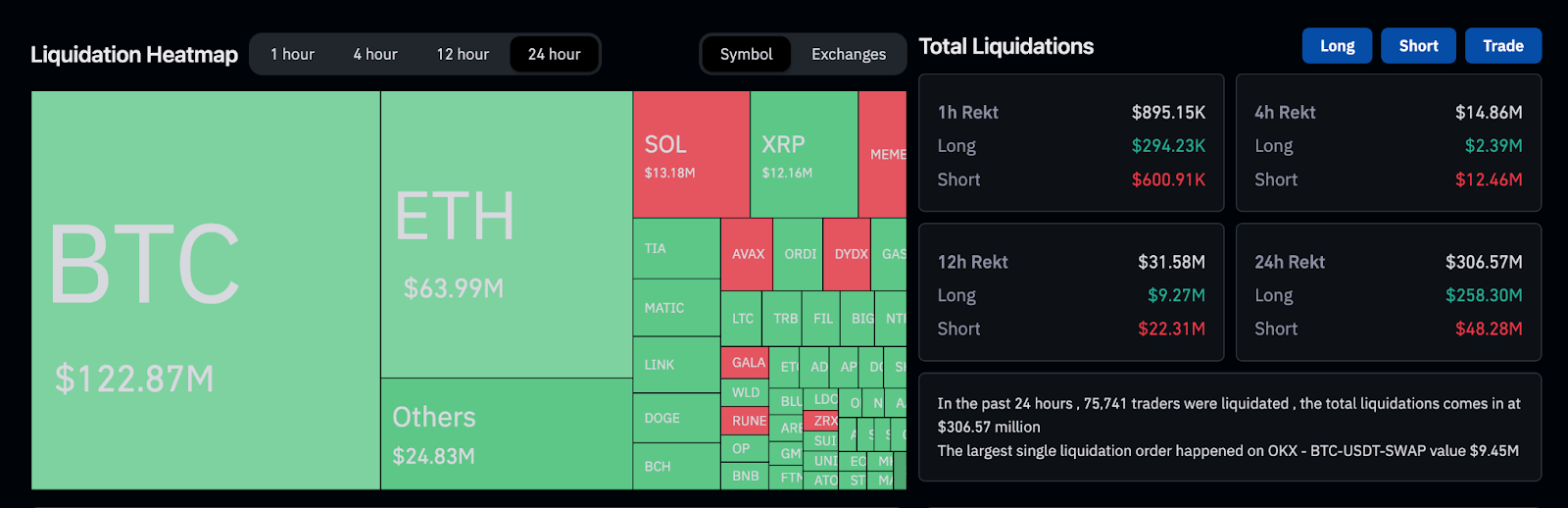

The 5% pullback resulted in liquidations worth over $300 million in the past 24 hours.

Crypto liquidations. Source: Coinglass

That being said, some traders anticipate that Bitcoin is ready to continue its uptrend. A crypto trader, Mister Crypto, wrote on X (Twitter):

“Bitcoin Funding Rates got reset, Most long positions got flushed out of the market. Ready to continue our trend to the upside.”

Read the full article here