This week has been exceptionally bullish for many major assets in the cryptocurrency market and some of the less-expected cryptocurrencies, including Terra Classic (LUNC), which has managed to grow its market value by nearly 16% on its weekly chart and close to 30% in just one month.

As it happens, the rebranded native asset of the disgraced Terra (LUNA) ecosystem has made a remarkable recovery, considering that the total value locked (TVL) on its chain in early August dropped to the lowest levels since its launch, sparking fears of its death.

Positive influences

Although its staking value has failed to make any significant progress since then, Terra Classic managed to keep its price relatively stable, returning into the green zone with its recent advances under the influence of positive developments around it and the optimistic sentiment in the wider crypto market.

Specifically, among these positive developments is the recent announcement by one of the largest crypto exchanges in the world, Binance, that it would adjust the leverage, margin tiers, and capped funding rate of several crypto perpetual contracts, including the 1000LUNCUSDT perpetual contract.

Terra Classic price analysis

Indeed, the price of LUNC at press time stood at $0.000072165, which represents an increase of 1.47% in the last 24 hours, adding up to the 15.71% gain across the previous seven days and the advance of 28.48% on its monthly chart, according to the information on November 10.

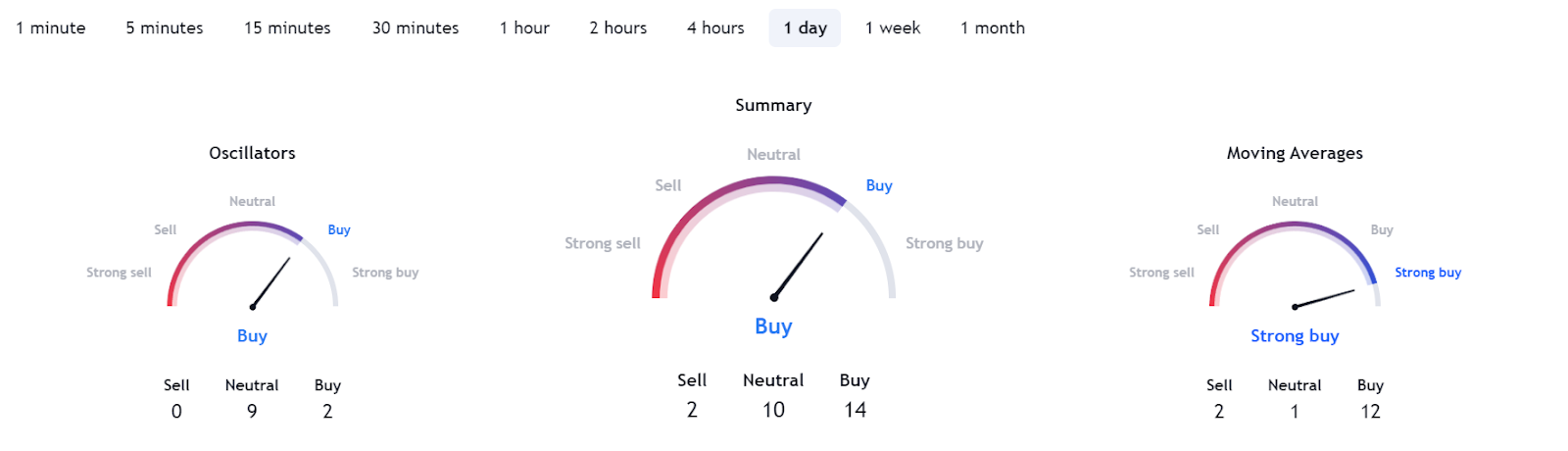

Additionally, the 1-day technical analysis (TA) gauges over at the finance and crypto analytics platform TradingView are optimistic about LUNC, suggesting a ‘buy’ at 14, as summarized from oscillators pointing at a ‘buy’ at 2 and moving averages (MA) in the ‘strong buy’ zone at 12.

All things considered, Terra Classic has made significant strides in recent weeks, and indicators suggest more strength could be in store, particularly considering the anticipation of a major LUNC burn that could increase its scarcity and, with it, the price.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here