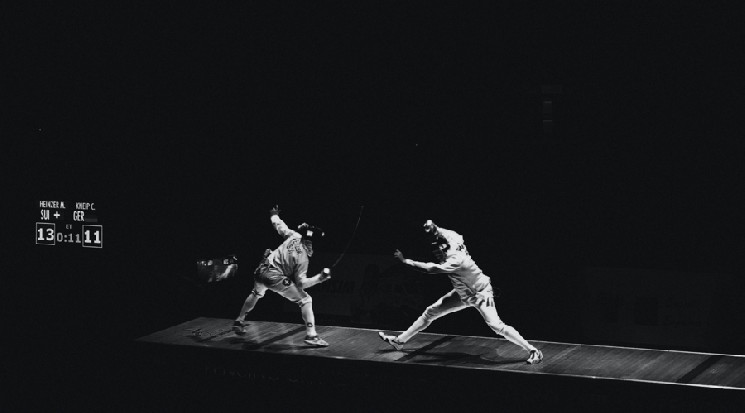

In the ever-shifting terrain of the financial sector, a nuanced battle is unfolding as traditional banks and blockchain technology firms vie for supremacy in deposit acquisition.

Established financial institutions, stalwarts of the industry, find themselves at a crossroads as they grapple with changing customer preferences and the disruptive force of evolving technologies. The struggle to amass deposits, a linchpin for these institutions, has become increasingly intense in the face of the disruptive innovations emanating from the blockchain technology sector.

A Clash of Ideologies

On one front, traditional banks, leveraging their time-honored reputation, regulatory adherence, and expansive customer base, are steadfastly asserting their relevance in this digital era. Simultaneously, the rise of blockchain technology introduces a new player into this financial arena – one characterized by agility, decentralization, and a resolute commitment to reshaping the landscape of financial transactions.

Recent strategic initiatives, exemplified by Polygon Labs’ substantial $85 million grant program, underscore the assertive moves made by blockchain technology firms to entice builders into their burgeoning ecosystems. The commitment demonstrated by Polygon Labs signals a dedication to fostering innovation within its network, incentivizing developers and content creators to contribute to the growth of its blockchain ecosystem.

The dichotomy becomes evident as blockchain technology firms endeavor not only to compete for deposits but to fundamentally redefine the traditional banking model.

Their focus lies in providing decentralized financial solutions, decentralized applications (DApps), and a more inclusive and efficient financial infrastructure, challenging the very essence of conventional banking practices.

In this evolving narrative, content and applications play a pivotal role. Blockchain technology firms are vigorously working to attract developers and builders who can craft compelling content and applications within their ecosystems.

This competitive landscape extends beyond mere financial transactions; it revolves around delivering a comprehensive and user-friendly experience that surpasses the offerings of traditional banks.

The Polygon Labs grant program acts as a microcosm of this broader trend, where blockchain technology firms actively invest in and incentivize the creation of innovative content and applications. This approach represents a clear departure from the conventional banking model, where innovation often encounters impediments due to regulatory constraints and entrenched legacy systems.

Blockchain projects like MATIC or Loopring (LRC) encompass not only the attraction of developers but also the creation of ecosystems conducive to collaboration and creativity. The goal extends beyond diverting deposits from traditional banks; it is about offering a dynamic and responsive financial ecosystem that aligns with the evolving needs of users.

In response, traditional banks are awakening to the necessity of adaptation.

Some have initiated explorations into blockchain technology, aiming to integrate its benefits while leveraging their established strengths. Nonetheless, the challenge remains substantial, as these financial institutions grapple with legacy systems, regulatory complexities, and ingrained practices that may impede the swift adoption of decentralized technologies.

The battle for deposits, therefore, transcends the immediate competition for funds. It embodies a clash of ideologies and approaches to finance. Traditional banks, fortified by their historical standing and the trust they’ve cultivated, are defending their territory. Conversely, blockchain technology firms are challenging the established norms, advocating for a decentralized and community-driven financial future.

Conclusion

The dichotomy between banks and blockchain technology firms in the battle for deposits sheds light on the seismic shifts underway in the financial industry. Initiatives like Polygon Labs signal that the competition is not merely about fund accumulation but about the content and applications that define the user experience. The financial landscape is undergoing a profound evolution, and the victors in this battle will be those adept at navigating the intricate interplay of technology, innovation, and user-centric solutions.

Read the full article here